bit bonds

Here’s a high-agency, narrative-driven thesis that captures the core ideas, mechanics, and implications of Saylor’s Bitcoin bond strategy:

🧠 Thesis: Saylor’s Speculative Attack – Strategy as a Capital Reallocation Machine

TL;DR:

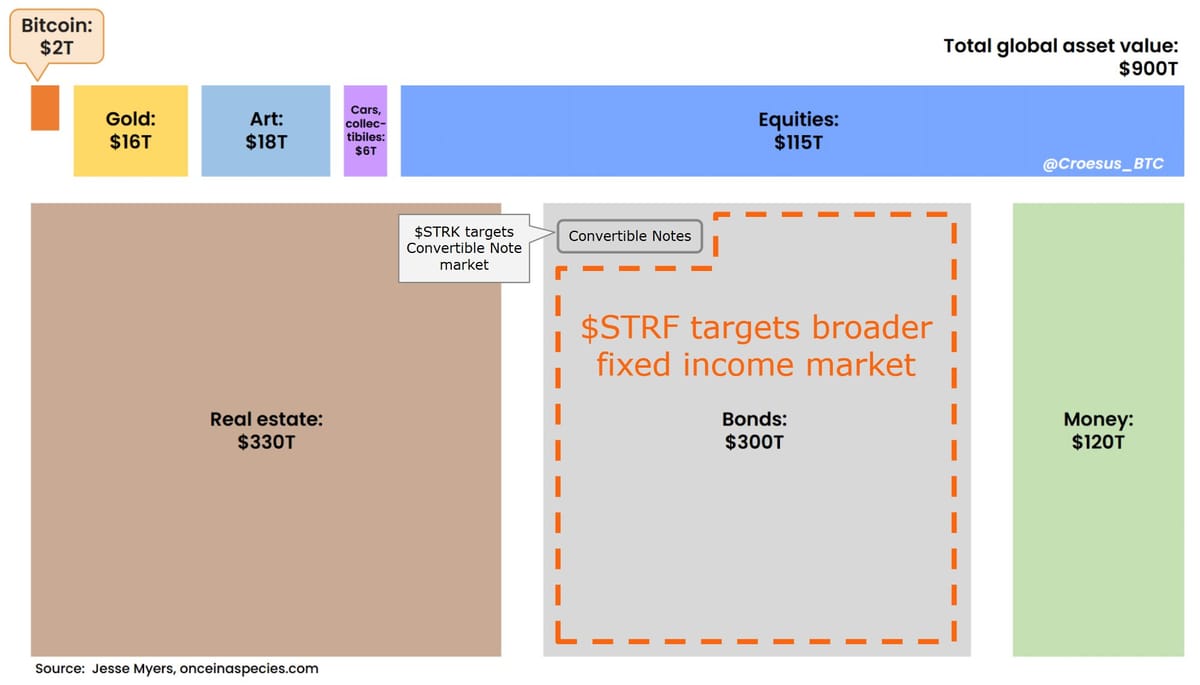

MicroStrategy ($MSTR), under Michael Saylor, isn’t just stacking Bitcoin—it’s engineering a structural arbitrage that turns the global bond market into a Bitcoin acquisition engine. By offering fixed-income investors yield-enhanced instruments like $STRK and $STRF, Strategy unlocks a $300T market traditionally off-limits to volatile assets like BTC. The play? Convert low-yield capital into high-performing Bitcoin—at scale.

🎯 The Mental Model:

Strategy is a pump — not a company in the traditional sense, but a financial machine designed to accelerate the flow of capital from low-return fixed income into hyperperforming Bitcoin.

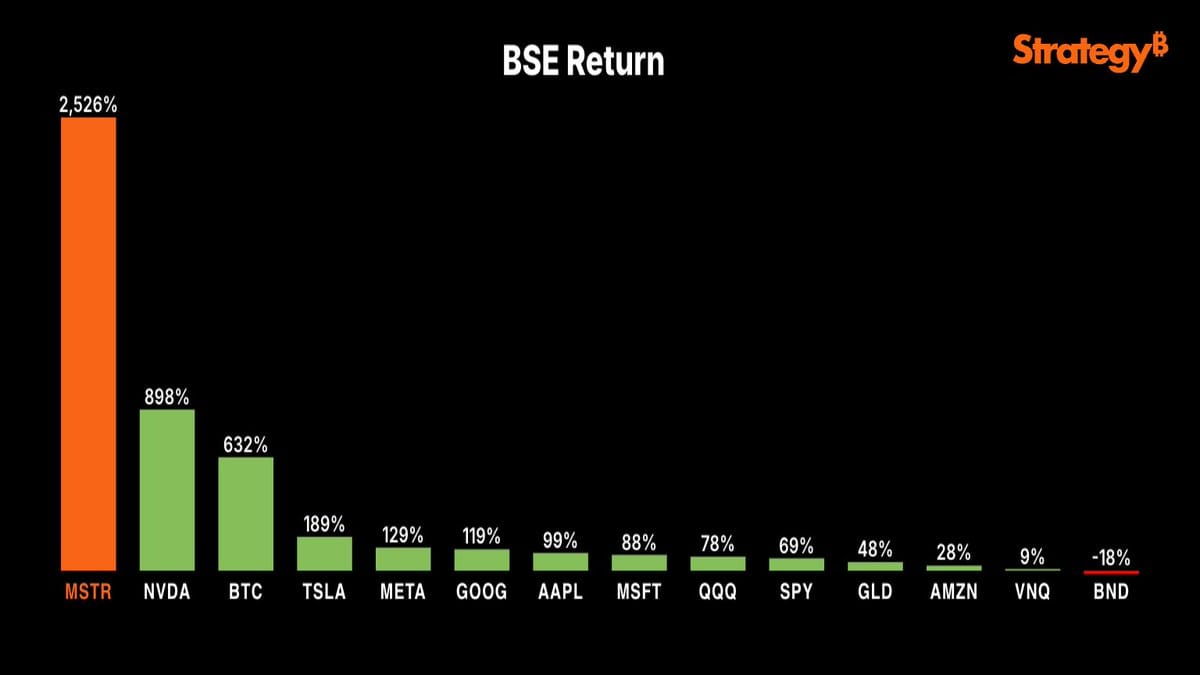

This is not just a speculative bet. It’s a structured yield play designed to underwrite BTC’s long-term appreciation with predictable interest obligations. Saylor’s bet is that Bitcoin will outgrow its interest liabilities by a wide margin—and so far, the math is on his side.

💡 The Arbitrage:

• Global Bonds: $300T earning 4–6% annually.

• Bitcoin: Projected by Saylor to grow ~50%+ in the near term, compounding slower over time.

• Convertible Notes & Yield Products ($STRK: 10%, $STRF: 11.8%):

• Offer institutions a “superbond” alternative.

• Fund BTC buys.

• Payout fixed returns (interest) from BTC appreciation.

If BTC grows >11.8% annually, this is net accretive.

Think of it as a carry trade on the entire bond market, with Bitcoin as the high-beta collateral.

🧩 Instruments of the Strategy:

1. Convertible Notes (targeting 2% of the bond market = $6T).

2. $STRK / $STRF: Fixed-yield public instruments designed to appeal to traditional fixed-income allocators.

These products abstract away Bitcoin volatility for institutions, replacing it with a reliable yield backed by BTC appreciation.

📈 The Numbers Game:

• 1% of the bond market = $3T.

• Bitcoin market cap = $2T.

• If $STRK / $STRF capture even a modest sliver of fixed-income reallocations:

• Strategy becomes the largest corporate Bitcoin buyer in history.

• Bitcoin’s price could reprices explosively from just this structured demand.

• $MSTR becomes a leveraged BTC proxy with institutional tailwinds.

This is no longer an “if individuals buy Bitcoin” story—it’s what if traditional fixed income reallocates en masse?

🏦 Why Fixed Income Players Will Bite:

• Yield-starved for over a decade.

• $STRF offers double the 10Y Treasury yield with BTC-backed exposure.

• Institutions can treat $STRK as a high-yield bond, not a crypto bet.

• Duration risk in bonds is high; Bitcoin offers convex upside.

It’s not crypto degen behavior—it’s rational capital allocation in a world of yield compression and inflation.

🧨 The Speculative Attack:

As coined by @BitcoinPierre, the “speculative attack” is when sound money is bought with borrowed soft money, initiating a self-reinforcing cycle:

1. Borrow fiat.

2. Buy BTC.

3. BTC appreciates.

4. Fiat debt becomes easier to pay off.

5. Repeat at scale.

Saylor has turned this from a micro play into a macro attack vector on fiat-based capital pools.

🔄 Osmosis Becomes Pressure:

Until now, BTC has grown via organic capital rotation—individuals reallocating from bonds, gold, or cash.

With Strategy’s new model, that osmotic trickle becomes a pressurized pipeline. The rate of capital flow into Bitcoin is now externally accelerated, institutionalized, and incentivized by yield.

🧬 Meta-Impact:

• $STRF and $STRK introduce a new class of crypto-exposed TradFi assets.

• MicroStrategy evolves into a Bitcoin asset manager, not a software company.

• New narrative: Bitcoin as yield-enhancing collateral—not just digital gold.

🚀 Strategic Implications:

• $MSTR becomes the first true Bitcoin ETF-equivalent with an embedded yield engine.

• Traditional fixed income players don’t have to understand Bitcoin, just compare 4.2% vs. 11.8%.

• This is not a crypto niche play—it’s macrostructural capital reallocation.

📜 Conclusion:

Michael Saylor is no longer playing the same game. With $STRK and $STRF, he’s executing a sovereign-level economic attack on the global bond market. The thesis is simple:

Borrow at 10%, earn 50%. Scale that to trillions.

The only question is: how fast will that pump run?

Bitcoin-Backed Bonds: A Deep Dive into MicroStrategy’s $STRK and $STRF

MicroStrategy’s Bitcoin-Backed Bonds – $STRK and $STRF

Overview: MicroStrategy (which now does business as “Strategy”) has issued two notable Bitcoin-centric bond-like instruments: $STRK (Series A “Strike” Preferred) and $STRF (Series A “Strife” Preferred). Despite being termed preferred stocks, these are essentially perpetual, Bitcoin-backed bonds in their economic behavior. Both were offered to raise funds (largely to buy more Bitcoin) and pay high fixed dividends to investors . Below is a breakdown of their structure, terms, and performance:

• Instrument Type: Both $STRK and $STRF are perpetual preferred equity – they have no maturity date and rank senior to common stock (i.e. preferred claim on assets/dividends) but are junior to all debt. They carry no voting rights , functioning as hybrid securities between debt and equity. These issues are SEC-registered offerings (under a shelf registration) underwritten by major banks , and they trade on Nasdaq (tickers STRK and STRF).

• Dividend Structure: $STRK promises an 8.00% annual dividend (fixed) on a $100 liquidation preference, while $STRF offers a 10.00% annual dividend on a $100 base . Dividends accrue quarterly for both. Crucially, STRK’s dividends are cumulative and can be paid in cash or in MicroStrategy class A common shares (at the company’s election) – if paid in stock, the shares are valued at 95% of their market VWAP, giving investors nearly cash-equivalent value . $STRF’s dividends are also cumulative; however, STRF dividends must be paid in cash (no stock payments) . If MicroStrategy ever misses a quarterly payment on STRF, the unpaid amount compounds at +1% per annum for each missed quarter, increasing the dividend rate up to a max of 18% until paid . This creates a strong incentive for the company to pay STRF on time. In sum, STRK provides an 8% yield with flexibility (and risk of payment in shares), whereas STRF provides a higher 10% cash yield with penalty interest if not paid.

• Conversion & Upside: A key differentiator is that $STRK is convertible into MicroStrategy common stock, whereas $STRF is not. Each STRK share can be converted (at the holder’s option, during specified quarterly windows) into 0.1 shares of MSTR class A common . This conversion ratio is effectively based on a $1,000 common stock price threshold – at $1,000+ per MSTR share, 0.1 share would equal the $100 preference value, and above $1,000 it would exceed it. In other words, if MSTR’s stock soars above ~$1,000, STRK holders can swap each preferred share for 0.1 common shares, capturing equity upside . Until such a scenario, STRK trades on its fixed income merits (8% dividend). By contrast, $STRF has no equity conversion feature . It is structured purely for income and capital stability, making it closer to a traditional bond in behavior.

• Issuance Details: MicroStrategy launched $STRK in late January 2025 as its first foray into perpetual preferreds. Initial target was $250 million, but investor demand was so strong that the deal was upsized to ~$563 million (7.3 million shares issued at $100 pref.) . Notably, to entice this demand, $STRK shares were offered at $80 each (a 20% discount to the $100 par) . At the $80 offer price, the effective yield was 10% (since $8 dividend on $80 cost = 10%) . This heavy discount signaled the yield required by the market. A few months later, in March 2025, MicroStrategy issued $STRF. The company initially sought $500 million, but increased the offering to ~8.5 million shares at $85 each, raising about $711 million net . Like STRK, STRF was also sold below its $100 face value (at $85) to bump the effective yield to ~11.8%. Both offerings were oversubscribed, indicating significant investor appetite for the high-yield BTC-backed proposition .

• Redemption and Security: Both preferreds are perpetual (no maturity) and not freely callable by the issuer for many years, unlike typical callable bonds. However, MicroStrategy negotiated certain special redemption clauses. If the outstanding shares fall below 25% of the original issue (e.g. if the company buys back or investors convert/sell off most shares), MicroStrategy can redeem all remaining shares at the greater of par or market price . Additionally, if certain tax or regulatory events occur, the company can redeem the preferreds . For STRF, there’s also a “fundamental change” clause: if a major change in control occurs, holders can require the company to repurchase their STRF at $100 plus accrued dividends . Importantly, these preferred stocks are unsecured and not specifically collateralized by MicroStrategy’s Bitcoin; however, investors are implicitly betting on the company’s vast Bitcoin holdings as de facto backing. As of early 2025 MicroStrategy held over 471,000 BTC on its balance sheet (worth ~$50 billion at the time) – a hoard providing a substantial equity cushion behind these preferreds. In fact, the value of Bitcoin on hand was about 5.8× larger than the sum of all company debt + preferreds, indicating a large asset cover (albeit a volatile one) .

• Legal and Regulatory Status: Legally, $STRK and $STRF are preferred equity under U.S. corporate law – meaning missed dividends do not trigger default (they simply accumulate), and holders’ recourse in bankruptcy would rank behind debt holders. They were issued under SEC-registered prospectuses (not as crypto tokens or private placements), fitting within the conventional regulatory framework for securities . MicroStrategy’s innovative twist is in use of proceeds (buying Bitcoin) rather than any regulatory exemption. The instruments comply with exchange listing standards and securities laws just like any other preferred stock or bond. Notably, the SEC and other regulators have not objected to MicroStrategy’s strategy of effectively creating Bitcoin-backed funding instruments – the compliance burden is similar to a normal corporate financing (with full disclosures of the risks related to Bitcoin volatility in the prospectus).

• Use of Proceeds: MicroStrategy explicitly stated that funds from these offerings would go to “general corporate purposes, including the acquisition of Bitcoin” . In practice, these financings are a cornerstone of CEO Michael Saylor’s strategy to accumulate more BTC. For instance, the $563M from STRK’s sale in Jan 2025 was promptly used to purchase 5,571 more bitcoins for MicroStrategy’s treasury . Likewise, the $711M from STRF will fuel additional BTC acquisitions. This effectively leverages fixed-income investors’ money to increase Bitcoin demand.

• Market Performance: So far, both STRK and STRF have traded near their issue prices in the secondary market, reflecting investor perception of fair yield. STRK debuted around $80 and has since drifted into the low $80s (still below its $100 par) . At ~$83, STRK’s current yield is about 9.6% . STRF just launched (at $85 offer), and given its higher coupon, it’s expected to trade around the mid-$80s as well (implying ~12% yield) until the market gains more information. Notably, these instruments have shown much lower volatility than Bitcoin or MicroStrategy’s common stock. For instance, within about a month of STRK’s launch, its price actually rose ~3% even as MSTR’s equity fell over 20% . This stability underscores that while the preferreds are exposed to Bitcoin’s long-term success (through MicroStrategy’s health), they behave more like income securities in the short term.

Figure: Price performance of STRK (red line) vs. MicroStrategy common stock MSTR (blue line) from early Feb to mid-Mar 2025. In its first weeks, STRK held steady (+2–3%) while MSTR fell over 20%, reflecting STRK’s lower volatility and fixed-income characteristics . Investors in STRK prioritized its 8% yield and preferred status, making it less sensitive to equity swings.

• Investor Reception: The strong uptake of both issues suggests investors view these Bitcoin-backed bonds favorably (at the right price). $STRK’s offering was nearly 3× oversubscribed relative to the initial target , and $STRF was upsized by over 40% due to high demand . Traditional finance firms were involved (Morgan Stanley, Citi, Barclays, etc. were book-runners) , and the securities now trade on a major exchange – indicating a level of mainstream acceptance. That said, the need to price at a discount (effectively offering double-digit yields) shows that investors demanded a hefty risk premium, given MicroStrategy’s leveraged Bitcoin strategy . In essence, yield-focused buyers were enticed by “bond-like stability with Bitcoin-linked upside” in STRK, or by STRF’s very high cash yield . We will discuss in later sections how different investor classes view these instruments.

In summary, $STRK and $STRF are novel financing tools that marry traditional preferred stock structures with Bitcoin-centric purpose. They provide MicroStrategy with billions of dollars to buy BTC, while giving investors coupon-like returns of 8–10% with varying degrees of equity upside. Next, we compare these to more traditional instruments and Bitcoin ETFs to highlight their uniqueness.

Comparing $STRK and $STRF to Traditional Bonds and ETFs

MicroStrategy’s Bitcoin-backed bonds differ markedly from plain-vanilla fixed income products and from Bitcoin ETFs. The table below summarizes key differences between MicroStrategy’s $STRK and $STRF vs. a typical corporate bond and a Bitcoin ETF:

|

Feature |

$STRK (8% “Strike” Pref) |

$STRF (10% “Strife” Pref) |

Traditional Corporate Bond |

Bitcoin ETF (Spot) |

|---|---|---|---|---|

|

Type / Structure |

Perpetual preferred stock (equity) ; behaves like bond+equity hybrid . |

Perpetual preferred stock (equity); fixed-income profile (non-convertible). |

Senior or subordinated debt security (fixed term). |

Exchange-Traded Fund holding BTC (trust units). |

|

Maturity |

None (perpetual; no maturity date). |

None (perpetual; no maturity date). |

Yes – fixed term (e.g. 5–10 years), then principal repaid. |

N/A – no maturity (open-ended fund). |

|

Coupon/Dividend Rate |

8% fixed annual dividend on $100 par (paid quarterly). |

10% fixed annual dividend on $100 par (paid quarterly). |

Fixed interest (coupon) e.g. 5–8% in high-yield; varies by credit rating. |

No interest or dividend (returns come from BTC price change). |

|

Payment Form |

Cash or stock (company option). Can pay dividends in MSTR shares (at 95% of market price) if needed . Cumulative if missed. |

Cash only (must be paid in cash; accumulates if missed, with interest +1% per missed quarter) . |

Cash interest only. Non-payment = default event. |

N/A – no payouts; holders realize gains by selling ETF shares. |

|

Duration of Payments |

Perpetual (no principal to repay; dividends indefinitely, or until conversion). |

Perpetual (dividends indefinitely, unless redeemed). |

Until maturity (interest + principal at end). |

Perpetual (can hold indefinitely). |

|

Conversion/Equity Upside |

Yes: Convertible into 0.1 shares of MSTR if stock hits ~$1,000 (10:1 ratio) . Allows upside if Bitcoin and MSTR soar. |

No: No conversion – purely income; price capped around par value. |

Typically none (unless it’s a convertible bond, which is separate category). |

N/A: ETF directly holds BTC; share price fully reflects BTC’s upside (or downside). |

|

Ranking/Seniority |

Equity – junior to all debt, but senior to common stock (has preference in liquidation) . No collateral. |

Same as STRK – equity, junior to debt, senior to common. No specific collateral (backed by issuer’s assets broadly). |

Debt – senior or pari passu with other debt; often secured by assets or senior in capital structure, giving stronger claim in default. |

Fund assets (BTC) are held in trust for shareholders. No issuer credit risk (aside from custodian risk). |

|

Yield to Investor |

~9–10% yield (at current ~$80s price) – high, reflecting Bitcoin-tied risk . Lower volatility than equity . |

~11–12% yield (at ~$85 price) – very high for a corporate security. Designed for income-focused investors. |

Varies; high-yield (“junk”) bonds in 2025 yield ~6–10% depending on risk. Investment-grade yields lower (3–5%). |

No yield; investors expect BTC price appreciation (or may earn negligible futures roll yield if a futures-based ETF). |

|

Bitcoin Price Exposure |

Indirect: Proceeds invested in BTC, so company’s solvency tied to BTC’s value. STRK price influenced by MicroStrategy’s BTC holdings health. Upside only if extreme BTC bull case (via conversion). |

Indirect: Backed by company that holds BTC. No direct price upside from BTC (fixed payout), but default risk increases if BTC crashes (company in trouble). |

None: Traditional bonds not tied to BTC (unless issuer is a crypto company). Bondholders usually have no direct crypto exposure – only issuer credit risk. |

Direct: ETF share price moves in lockstep with BTC market price (offers pure exposure minus small fees). No credit risk of an operating company. |

|

Regulatory Status |

SEC-registered preferred stock ; governed by corporate law (Dividends can be skipped without immediate default). Listed on Nasdaq. |

SEC-registered preferred stock; listed on Nasdaq. (Both STRK/STRF comply with SEC, no special crypto regulation needed). |

SEC-registered bond or 144A placement; subject to bond covenants. Legal default if payments missed. |

Regulated investment fund (SEC ’40 Act for spot ETFs, if approved). Must custody Bitcoin per regulations. |

Key Takeaways: MicroStrategy’s STRK/STRF mimic many features of traditional high-yield bonds (fixed income, periodic payments) but lack maturity and carry equity-like risk. Unlike a normal corporate bond, these instruments can defer payments (without default) and, in STRK’s case, even pay with stock – flexibility typical of equity. They offer much higher yields than most mainstream bonds to compensate for Bitcoin volatility and junior status . In essence, STRK/STRF investors are lending to a Bitcoin-holding company, accepting higher risk for the promise of 8–10% annual returns.

In comparison to a Bitcoin ETF, STRK/STRF provide a very different exposure profile. A spot Bitcoin ETF would simply hold BTC – offering direct price exposure but no yield. MicroStrategy’s bonds, on the other hand, provide income but limit the upside. If Bitcoin’s price doubles, an ETF’s value doubles, whereas STRK/STRF would likely still trade near par (they don’t participate in BTC gains, aside from STRK’s remote conversion option). However, if Bitcoin crashes, ETF holders lose value but do not face default, whereas STRK/STRF holders risk the company failing to meet obligations (though the company can issue stock or dip into reserves to try and pay dividends). Some analysts describe MicroStrategy’s bonds as a way to “blend traditional fixed-income with Bitcoin’s upside potential” , but in practice the upside is limited and the main attraction is yield. Investors who want pure Bitcoin exposure would prefer an ETF or direct BTC; those who want yield + some Bitcoin-tied exposure might find STRK/STRF intriguing. These bonds can also appeal to fixed-income mandates that can’t hold crypto directly – effectively wrapping Bitcoin exposure in a bond-like package.

Broader Adoption of Bitcoin-Backed Bonds

MicroStrategy is not alone in exploring Bitcoin-backed debt instruments. There is a wider trend of entities issuing bonds tied to Bitcoin, ranging from sovereign nations to crypto mining firms:

• El Salvador’s “Volcano Bonds” (Sovereign Bitcoin Bond): El Salvador, the first country to adopt Bitcoin as legal tender, is pioneering a sovereign Bitcoin-backed bond. Announced in late 2021 by President Nayib Bukele, the so-called “Volcano Bond” is a proposed $1 billion government bond backed by Bitcoin proceeds . The plan received legislative approval in 2023, and the bonds are expected to launch in early 2024 on a regulated platform . Key features (as initially outlined) include: a 10-year maturity, 6.5% annual coupon interest, and allocation of half the bond proceeds ($500M) to buy BTC (the other half to fund geothermal energy infrastructure and build a “Bitcoin City”) . The bond is nicknamed “Volcano” because it leverages geothermal power from volcanoes for Bitcoin mining. Uniquely, El Salvador intends to issue the bond as a digital token on Blockstream’s Liquid Bitcoin sidechain, with crypto exchange Bitfinex as the book-runner . Investors in the Volcano Bond will not only receive the 6.5% coupon, but potentially an “additional dividend” after 5 years if Bitcoin’s price rises – the government plans to periodically sell some of the purchased BTC (after a lock-up) and share profits with bondholders . This innovative structure effectively makes bondholders participate in BTC upside beyond the fixed interest. El Salvador’s initiative represents the first nation-state Bitcoin bond. If successful, it could set a template for other countries or municipalities to raise funds via tokenized bonds collateralized by or linked to Bitcoin. (At the 2021 announcement, optimism ran high – one advisor speculated that many countries might follow, though this remains to be seen .)

• Corporate Bitcoin Bonds (Bitcoin Miners and Others): MicroStrategy’s strategy of issuing debt to buy Bitcoin has indirectly inspired or coincided with similar moves by companies in the crypto sector. Several Bitcoin mining companies have issued convertible bonds to fund their growth and treasury:

• Marathon Digital Holdings (MARA) – a major Bitcoin miner – issued $650 million of 1% convertible notes due 2026 in late 2021, explicitly to buy Bitcoin and mining equipment. In 2024, Marathon went further, issuing $850 million of zero-coupon convertible notes (due 2031), with plans to use a large portion of the net proceeds (~$835M) to acquire Bitcoin (and to refinance earlier debt) . This essentially mirrors MicroStrategy’s playbook in a mining context.

• Riot Platforms (RIOT) – another leading BTC miner – likewise issued hundreds of millions in convertible bonds (for example, $500M in 2023) to bolster its balance sheet. These notes are not “Bitcoin-backed” in a collateral sense, but the issuers’ fortunes are tied to Bitcoin’s price, similar to MicroStrategy. Investors buying these convertibles are implicitly betting on Bitcoin’s success (since if BTC surges, the companies’ stocks surge and the bonds can convert profitably).

• Coinbase – While not for Bitcoin purchase per se, even crypto exchange Coinbase issued $2 billion of bonds in 2021 to invest in growth (those bonds’ performance has been linked to crypto market health). This shows large-cap crypto firms tapping bond markets.

• Other Examples: Outside of public markets, there have been tokenized bonds and loans in crypto. For instance, in the decentralized finance (DeFi) realm, protocols enabled Bitcoin-collateralized loans (though those are not tradable bonds in the traditional sense). Blockstream, a Bitcoin infrastructure firm, launched a “Blockstream Mining Note” token for qualified investors in 2021, which was essentially a bond-like instrument providing returns based on Bitcoin mined by purchased equipment – another form of Bitcoin-backed security. These are early experiments in marrying Bitcoin with fixed-income products.

• ETF and Fund Products Targeting Bitcoin Bonds: Another sign of broader adoption is the emergence of funds dedicated to Bitcoin-backed bonds. In March 2025, REX Shares launched the Bitcoin Corporate Treasury Bond ETF (ticker: BMAX), an exchange-traded fund that holds a basket of corporate bonds from companies that hold Bitcoin. Notably, 81% of BMAX’s portfolio is in MicroStrategy’s own convertible notes and preferreds, with the remainder in similar debt from Marathon and Riot . REX’s CEO Greg King remarked that previously these bonds were hard for retail investors to access, and the ETF “removes barriers” to invest in the strategy pioneered by Saylor . Additionally, Strive Asset Management (co-founded by Vivek Ramaswamy) filed for a “Bitcoin Bond ETF” in 2024, aiming to invest 80%+ in bonds of companies that use debt to buy Bitcoin . These developments indicate growing institutionalization – packaging Bitcoin-backed bonds into ETFs could significantly broaden investor reach. It also suggests that the market for such bonds is expected to grow (since an ETF will need a diversified basket over time, potentially spurring more issuance from other firms or countries).

In summary, MicroStrategy’s $STRK and $STRF exist in a growing ecosystem of Bitcoin-backed debt instruments. El Salvador’s sovereign bond is a landmark to watch in 2024, potentially opening the door for other governments or quasi-sovereign entities (like city bonds funded by Bitcoin holdings). Public corporations in the crypto space (miners, fintech firms) have already embraced issuing debt for Bitcoin accumulation. And on the investment side, new funds and ETFs are being created to bundle these instruments, which could further normalize the concept of Bitcoin-backed bonds.

Institutional Appetite and Investor Response

The reception from traditional fixed-income investors and institutions toward Bitcoin-backed bonds has been cautiously optimistic, driven largely by the allure of high yields and a new way to gain crypto exposure:

• Strong Demand and Oversubscription: Both of MicroStrategy’s offerings saw significant oversubscription, indicating real appetite from investors. $STRK’s bookbuild was reportedly oversubscribed nearly 3× (target $250M vs. $563M raised) , and $STRF was increased from $500M to over $700M due to high demand . Such oversubscription is a positive signal – it means multiple investors (likely hedge funds, family offices, and some institutional allocators) were eager to lend to MicroStrategy at the right price. Indeed, the presence of big-name underwriters (Morgan Stanley, Citi, Barclays, etc.) in these deals shows that Wall Street banks were confident in placing the paper with their clients. Those clients, in turn, were enticed by yields of 9–10% which are quite high in today’s environment, even compared to junk bonds. As Protos Media noted, “there is always unlimited demand for an investment with excellent terms” – in this case, the “excellent” terms were the generous coupon and discount. In effect, MicroStrategy had to sweeten the deal (offering a 20% discount to par, as discussed) to get this strong response , but once that was done, investors piled in.

• Investor Profile – Who’s Buying? The precise buyers aren’t publicly disclosed, but we can infer the profile:

• Fixed-Income Funds and Yield Investors: The 8–10% yields on STRK/STRF likely attracted high-yield bond funds, credit hedge funds, and income-oriented investors willing to take on risk. Compared to similarly yielding junk bonds, STRK/STRF come with an unusual crypto twist, but also an equity-like upside (for STRK) that some hybrid debt/equity funds might find attractive.

• Crypto-Believers with Mandates: Some crypto-focused investment firms or even Bitcoin “treasuries” might buy these bonds as a way to earn yield on a Bitcoin bet. For example, a crypto hedge fund that is bullish on MicroStrategy could prefer holding STRK for 8% yield rather than MSTR stock which pays no dividend. It’s notable that the analyst community covering MicroStrategy has warmed to these instruments – Wall Street analysts viewed the clarity around such Bitcoin-financed acquisitions positively , suggesting they see a viable investor base for them.

• Retail and Advisors (via ETFs): Direct retail participation in individual preferreds is limited, but the launch of ETFs like REX BMAX is changing that. Now financial advisors and smaller investors can effectively allocate to a basket of Bitcoin-backed bonds through an ETF . The BMAX ETF’s debut with ~$25M AUM indicates modest but notable interest, and its holdings being 81% MicroStrategy debt shows just how central MSTR is in this niche . Additionally, the filing of Strive’s Bitcoin Bond ETF (awaiting SEC approval) points to expected future demand – Strive is likely betting that advisors want a product to invest in the “Bitcoin via bonds” theme for clients. If approved, such an ETF could channel even more institutional money into these bonds (for example, pensions or endowments might be more comfortable buying an ETF share than directly handling a MicroStrategy preferred stock).

• Traditional vs. Crypto Market Perspectives: It’s interesting to note a contrast in how different market commentators reacted. Crypto media heralded the oversubscription of STRK as a very bullish sign – framing it as institutions eagerly gaining Bitcoin exposure through MicroStrategy . Traditional financial media, however, focused on the cost of that capital: Barron’s pointed out that the new preferred had to be sold at a steep discount and yields ~10%, implying investors see it as a risky bet . Both views are valid: there is genuine interest from institutional investors, but primarily because the risk premium (yield) is sufficiently high. In other words, fixed-income investors are willing to dabble in Bitcoin-backed instruments if they feel they are being paid for the risk. An 8–12% yield was evidently enough compensation.

• Allocation Trends and Pilot Investments: We are seeing the early stages of allocation to such assets. Some anecdotal signs:

• The oversubscription suggests that many investors put in orders, likely testing small allocations to this new asset class (e.g., a multi-billion dollar fund might allocate a small percentage into STRK as a trial).

• As MicroStrategy continues to pay the quarterly dividends reliably (the first cash dividend for STRK is scheduled for Mar 31, 2025 ), confidence may build, potentially increasing demand and trading volumes.

• If the Bitcoin-backed El Salvador bond launches successfully, that could further validate the concept and draw in emerging markets bond investors or sovereign wealth funds looking for crypto exposure via a sovereign credit. Success there could spawn copycats (other countries or state-owned enterprises issuing Bitcoin bonds), broadening the market and attracting global allocators.

• On the flip side, institutional investors are also evaluating the risks. Credit rating agencies have not officially rated STRK/STRF (being equity, not debt), but they have noted MicroStrategy’s overall debt is high relative to its cash flows – meaning these preferreds are heavily dependent on Bitcoin appreciation or equity issuance for long-term sustainability. Some conservative institutions will thus stay on the sidelines or limit exposure until a longer track record is seen.

• Wall Street’s Creative Acceptance: The creation of an ATM (At-The-Market) program for STRK up to a massive $21 billion is a notable development . This means MicroStrategy has the flexibility to continuously sell more STRK shares into the market over time. The fact that this was filed (and presumably supported by underwriters) indicates an expectation that there will be ongoing investor appetite to absorb more Bitcoin-backed preferred stock in the future. Essentially, MicroStrategy has a potential pipeline to raise up to $21B (subject to market conditions) via STRK sales . This enormous figure points to a bold assumption: if Bitcoin’s value keeps rising and MicroStrategy’s strategy proves out, demand for its Bitcoin-backed bonds could scale dramatically (with institutions potentially treating STRK almost like a high-yield quasi-ETF for Bitcoin exposure). Of course, $21B is not a committed raise – it will only materialize if the market continues to buy in.

Overall, institutional response can be summed up as cautiously enthusiastic. Traditional investors are increasingly willing to allocate to Bitcoin-related debt provided the structure is familiar (e.g. a bond or preferred stock) and the returns are attractive. MicroStrategy’s experiments have essentially opened a new channel for Bitcoin to enter portfolios via fixed-income sleeves, and the initial uptake and creation of related ETFs suggest this channel is viable. As one crypto analyst put it, MicroStrategy is offering “a stable 8–10% dividend that surpasses many bonds, but backed by Bitcoin” – a proposition that intrigues yield-hungry investors, even if they remain watchful of the underlying crypto risks.

Impact on Bitcoin’s Price and Market Dynamics

The advent of Bitcoin-backed bonds and large-scale issuance of such instruments can have meaningful effects on Bitcoin demand and price dynamics:

• Direct BTC Demand from Issuances: When entities raise capital through these bonds to buy Bitcoin, it creates immediate, substantial buy pressure on BTC. MicroStrategy is the prime example – it has consistently converted debt/equity raises into Bitcoin purchases. With the $563M STRK proceeds in Jan 2025, the company acquired thousands of BTC virtually overnight . By March 2025, after multiple raises, MicroStrategy’s holdings reached 506,137 BTC (over 0.5 million bitcoins) , making it the largest corporate holder. Every time MicroStrategy issues new securities (be it STRK, STRF, or even sells common stock via an ATM), a portion of that capital flows into the Bitcoin market, often in a short time frame. These large buy orders can contribute to upward price momentum. While the Bitcoin market is very large (market cap in the trillions by 2025), marginal demand increases can still move the price, especially during bull markets. For perspective, MicroStrategy’s 506k BTC stash is about 2.4% of the roughly 21 million BTC supply (and an even larger fraction of the actively traded float, since many BTC are lost or long-term held) – representing a significant absorption of supply . As more companies or funds attempt similar BTC-backed raises, they collectively act as persistent buyers. This “corporate bid” for Bitcoin can help soak up sell pressure and support the price.

• Long-Term Supply Reduction: Many of the BTC purchased via bond proceeds are effectively taken out of circulation for the long term. MicroStrategy has made clear it is a long-term holder (viewing BTC as treasury reserve). El Salvador’s bond design locks up some portion of BTC for several years as well. This means a chunk of Bitcoin is removed from liquid markets and held in treasuries or reserves. By reducing available supply, basic economics suggest that if demand continues or grows, prices should rise. President Bukele and advisors have explicitly pitched the Volcano Bonds in these terms – removing Bitcoin from the market to drive scarcity. Samson Mow (a crypto executive involved in El Salvador’s plans) noted that if multiple such sovereign bonds launch, it could take billions of BTC supply off the market, creating a Bitcoin supply shock . While some claims (e.g. taking “half of bitcoin’s market cap” off the table with a few bonds ) were hyperbolic, the core idea holds: widespread issuance of Bitcoin-backed bonds translates to significant hodling of BTC by institutions, reinforcing Bitcoin’s scarcity value.

• Market Sentiment and Legitimization: Each successful Bitcoin bond issuance can shift sentiment positively for Bitcoin itself. These instruments effectively signal confidence in Bitcoin’s future by both issuers and investors – the issuer is leveraging itself to buy BTC, and investors are willing to bet on that strategy. This can create a feedback loop: news of oversubscribed offerings or new sovereign adopters can boost Bitcoin’s price as traders anticipate increased demand. For example, MicroStrategy’s aggressive accumulation (enabled by its bond issuances) during 2020–2021 was often cited as a factor in Bitcoin’s bull run, as it catalyzed other firms to consider similar moves and signaled institutional conviction. In early 2025, the wave of new Bitcoin financial products (spot ETFs, bond ETFs, preferreds) added to a narrative of growing mainstream integration, likely contributing to Bitcoin’s strength (Bitcoin was trading around all-time highs in the $80k–100k+ range by Q1 2025 ).

• Volatility and Systemic Effects: A double-edged aspect is that while bond-fueled buying can drive prices up, the introduction of leverage and fixed obligations can add fragility on the way down. If Bitcoin’s price were to sharply decline, highly leveraged holders like MicroStrategy could face financial stress – for instance, if the value of its BTC falls far below the debt on its balance sheet, it might struggle to service interest or dividends (especially for STRF, which requires cash payouts). In extreme scenarios, such companies might even be forced to sell Bitcoin reserves to meet obligations, which could amplify a downtrend. So far, MicroStrategy has managed risks by raising equity and having a large equity cushion, but the risk of a feedback loop in a severe Bitcoin bear market exists: falling BTC -> panic about MicroStrategy’s solvency -> bond prices fall, yields spike -> harder for company to raise cash -> possible need to sell BTC -> further BTC price pressure. This is a downside scenario to monitor. On the flip side, in a bull scenario, a virtuous cycle can occur (as described in a Forbes analysis of Saylor’s “Bitcoin flywheel”): issuing debt to buy BTC -> BTC price rises -> MicroStrategy’s net worth rises -> its stock rises -> it can issue more securities at good terms -> buy more BTC, and so on . This seems to be playing out: MicroStrategy’s common stock tends to surge with BTC, giving it opportunities to sell shares (or preferreds) at high valuations and plow the proceeds into even more Bitcoin.

• Scale of Impact – Forward Looking: If Bitcoin-backed bonds remain a niche experiment, their impact on price will be marginal. However, if this concept scales up to the trillions (e.g., multiple countries issue Bitcoin bonds, major corporations allocate treasury via such bonds, or even Bitcoin ETFs start holding these bonds as part of strategies), then the dynamic could materially shape Bitcoin’s trajectory. Large-scale bond issuance could effectively transfer a significant portion of Bitcoin supply into long-term investment vaults, tightening supply. Some have likened this to the role gold-backed bonds or central bank purchases play for gold – creating a floor under the market. El Salvador’s team even invoked game theory: the first movers (like El Salvador) enjoy the biggest gains, and laggards will have to buy in at higher prices later . While such claims are promotional, we can foresee that if, say, a G20 nation issued a Bitcoin bond or a Fortune 100 company emulated MicroStrategy, it would likely spark a noticeable rally simply due to the perceived legitimacy and actual buying volume.

• Empirical Evidence: It is always hard to directly attribute Bitcoin’s price movements to single factors, given the global scope of the market. That said, we have some evidence around the timing of buys. For instance, when MicroStrategy announced new purchases or offerings in past years, there were often short-term bumps in BTC price (correlated with the news or the anticipated buying). More concretely, Bitcoin’s price in late 2024 and early 2025 climbed as MicroStrategy accumulated – by January 2025, Bitcoin was around $84k–$106k (a substantial increase from a year prior), and MicroStrategy’s buying of tens of thousands of BTC during that period likely contributed to the momentum (alongside other factors like macro conditions and ETF approvals). On the sovereign side, simply the announcement of El Salvador’s bond plans in late 2021 and the legal framework in 2023 were interpreted as bullish signals, although delays in issuance tempered the effect. Should the bond actually launch and $500M of Bitcoin be bought with the proceeds, we would expect a direct upward impact on price (though $500M is a small fraction of daily BTC volume, it’s still a significant buy if done over a short span).

In conclusion, Bitcoin-backed bonds generally increase net demand for Bitcoin, as they channel capital from traditional investors into Bitcoin purchases. They also represent a novel form of “institutional adoption” – not simply holding or ETF investing, but leveraging Bitcoin on corporate balance sheets. In a forward-looking view, if such bonds become common financing tools, Bitcoin’s price could be buoyed by a steady stream of institutional buying and reduced circulating supply. Michael Saylor has often spoken of Bitcoin as “digital gold” and encourages firms to lever up to buy it; if many follow that philosophy, the effect could be analogous to gold in the Bretton Woods era (where government and bank actions propped up demand). Of course, investors and crypto market participants should remain aware of the risks of leverage: these bonds introduce debt into the crypto ecosystem, and while that can amplify gains (via more buying), it can also amplify stress during downturns. Nonetheless, the current trajectory suggests that Bitcoin-backed bonds are shaping Bitcoin’s market by embedding it into traditional financial structures – a trend that could significantly influence Bitcoin’s price dynamics in the years ahead.

Sources:

• MicroStrategy press release on $STRF offering and terms ; CoinDesk analysis comparing STRK vs STRF.

• Reddit analysis of STRK prospectus (conversion, dividend payment in stock).

• CryptoSlate and CoinDesk news on STRK issuance and oversubscription.

• CoinDesk market data on STRK trading and performance vs MSTR.

• Reuters coverage of El Salvador’s Bitcoin bonds (Volcano bonds) and CoinDesk update on regulatory approval.

• Decrypt report on REX’s Bitcoin Treasury Bond ETF (BMAX) and BitcoinTaxes insight on Bitcoin Bond ETFs.

• Press and filings on Marathon’s convertible notes for Bitcoin purchases.

• CoinDesk and Barron’s commentary on MicroStrategy’s strategy, yields, and investor reception.

• CoinDesk article on MicroStrategy’s Bitcoin holdings and share issuance strategy.

• Reuters and CoinDesk on Bitcoin supply impact and Samson Mow’s comments .