BTC

Managing money effectively is a multifaceted process that hinges on the integration of three core components: making money, maintaining wealth, and ensuring consistent cash flow. These components work together much like the stages in baking bread, where each step is crucial to the final product.

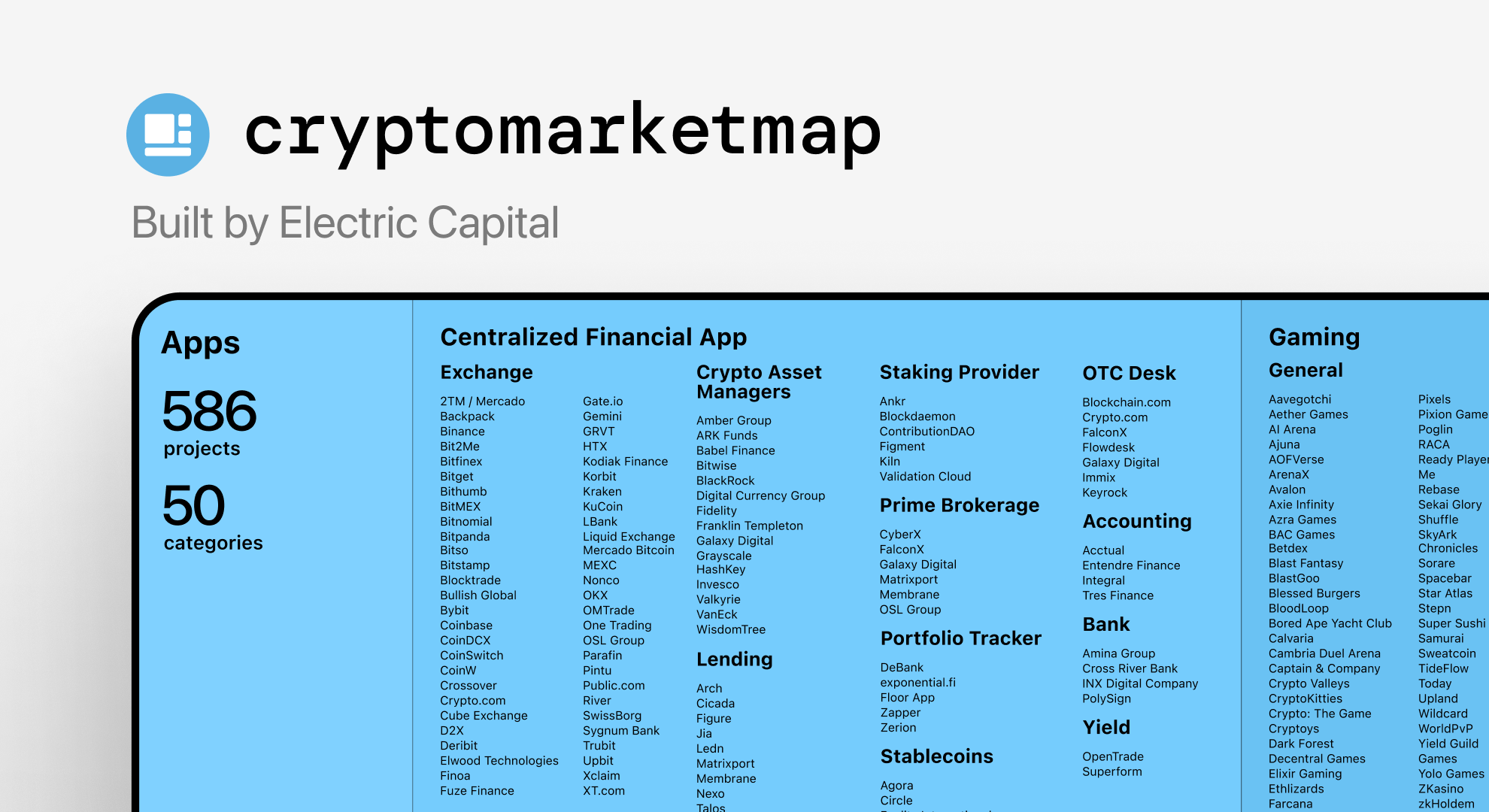

The document titled "Electric Capital Market Map" provides an extensive overview of various projects, categories, and tech layers in the blockchain and cryptocurrency ecosystem. The document segments over 62024 unique projects into 137 categories, showcasing the diverse and expansive nature.

Identity & Data Management / Human Resource Coordination / Computing Resource Coordination / Wallets / Social Networks & Messaging / Gaming & Metaverse / Collectibles & Asset Marketplaces / Centralized Financial Apps / Developer Tools & Services / Scaling Solutions / Core Infrastructure / Decentralized Financial Protocols /

Making Money: The Dough in the Oven

In the baking analogy, making money can be likened to the dough in the oven. This stage involves actively earning income through various means such as employment, investments, or business ventures. The dough, much like income, is in a state of potential—it is the transformation process where raw materials (effort, skills, and resources) are converted into something of greater value.

However, it’s important to recognize that the dough in the oven is not yet bread. It represents potential wealth that is still subject to numerous variables and risks. Just as dough can be undercooked, overcooked, or even ruined by unforeseen factors, income generation is fraught with uncertainties. Market fluctuations, economic downturns, and personal setbacks can all impact the final outcome.

Maintaining Wealth: The Bread

Maintaining wealth is akin to having the finished bread. This is the stage where potential earnings have been realized and converted into tangible assets and savings. It’s the wealth you have successfully retained after navigating the uncertainties of income generation.

Wealth maintenance requires prudent financial management, including investing wisely, diversifying assets, and protecting against risks. It’s about ensuring that the bread you have made is preserved and can sustain you over time. This often involves strategies such as saving for retirement, investing in stable assets, and creating an emergency fund. It is crucial not to confuse the dough (potential income) with the bread (actual wealth). Many people fall into the trap of counting their dough as wealth, only to find that their financial stability is illusory.

Cash Flow: Sourcing the Ingredients

Cash flow is the process of sourcing the ingredients necessary for making dough, which in turn becomes bread. It involves managing the inflow and outflow of money to ensure that there is always sufficient capital available to meet expenses and invest in opportunities.

Effective cash flow management means maintaining a steady stream of income and keeping expenses under control. It requires planning, budgeting, and monitoring to ensure that the money coming in consistently exceeds the money going out. Just as a baker needs a reliable supply of ingredients to continue baking, individuals and businesses need a stable cash flow to sustain their financial activities.

The Integrated Approach to Financial Management

To manage money well, it’s essential to seamlessly integrate making money, maintaining wealth, and cash flow management. Focusing solely on making money without attention to wealth preservation and cash flow can lead to financial instability. Many people wake up one day to find their wealth depleted because they only concentrated on income generation, neglecting the other critical components.

For instance, if your net worth is tied up entirely in high-risk investments, you are essentially counting your dough as bread. High-risk assets can offer significant returns, but they also come with the possibility of substantial losses. Until these assets are converted into more stable forms of wealth, they remain potential rather than actual wealth. Thus, having 100% of a million dollars in altcoins means you have zero dollars and zero Bitcoin in terms of stable, tangible wealth.

By focusing on cash flow, you can ensure a continuous supply of capital to keep making dough. This allows you to experiment and take risks, knowing that even if some dough burns or a recipe fails, you still have the means to make more. It’s about creating a sustainable financial ecosystem where income generation, wealth preservation, and cash flow support and reinforce each other.

Managing money well is about understanding the distinct but interconnected roles of making money, maintaining wealth, and managing cash flow. It’s about recognizing that potential income is not the same as actual wealth and ensuring that you have the means to sustain and grow your financial resources over time. Just as a baker must carefully source ingredients, monitor the baking process, and protect the finished bread, individuals must balance these three components to achieve long-term financial success.