Ceci N’est Pas Un NFT

The Surreal World of the Grand Ursine Gallery

Beneath the soft glow of an eternal dusk, in a realm where blockchain and art intertwined, stood The Grand Ursine Gallery—a sanctuary of digital masterpieces, curated across 69+ NFT marketplaces, each piece breathing with the pulse of the decentralized universe . Within its hallowed halls, where AI-driven curators shaped exhibitions in real-time, a lone figure emerged—a bear unlike any other.

He was known as the Surrealist Bear, a digital enigma woven from dreams and algorithms. Wrapped in a viridian coat embroidered with surreal motifs, he carried the wisdom of old masters like Magritte while pulsing with the raw energy of contemporary crypto culture . Tonight, his journey would take him deeper into the heart of this extraordinary world, beyond mere collections and into the very fabric of decentralized existence.

Guardians of the Gate

The entrance to this grand domain was guarded by Blockchain Bouncer, a figure of effortless charm and unshakable security . “Bonjour, hola, credentials, please,” he greeted, his digital gaze scanning the Surrealist Bear’s holdings, verifying his identity through ENS databases and thirdweb’s Nebula AI. Behind him, an intricate system worked tirelessly, ensuring the integrity of the marketplace—sweeping for undervalued gems, detecting wash trading, and predicting market movements with ruthless precision.

“You’re in,” Bouncer grinned, swinging open the gates.

The Pulse of the Digital Marketplace

Inside, the bear wandered through a labyrinth of shifting data streams, arriving at the observatory where Analytical Bear ruled supreme . Screens pulsed with the heartbeat of the NFT economy—GeckoTerminal pools, AI-driven market analytics, and Nebula-powered blockchain scans. Here, DeFi intelligence wasn’t just observed; it was shaped.

“How accurate are your predictions?” Surrealist Bear asked, mesmerized by the living sea of information.

Analytical Bear adjusted his lenses, eyes reflecting cascading price movements. “Institutional-grade intelligence, refined in real-time. Our AI models don’t just predict trends—they sculpt them.”

The Surreal World of Ikigai

Beyond the data observatory lay the chamber of the IKIGAI Protocol, the self-sustaining heart of this digital reality . Here, tokens and art intertwined in an intricate dance of value creation. Genesis Bears were minted with shimmering BERA tokens, their existence reinforcing the IKIGAI ecosystem through dynamic buybacks and deflationary mechanisms.

“Every collector strengthens our cycle,” mused Philosopher Bear, his paws resting on scrolls of decentralized knowledge. Timekeeper Bear adjusted the algorithmic clockwork, ensuring adaptive emissions responded to shifting market conditions.

Surrealist Bear marveled at the sheer elegance of it all—a world where identity, creativity, and finance converged into a single, evolving ecosystem.

Ceci N’est Pas Un NFT

And then, at the center of it all, a paradox. A simple parchment inscribed with a message:

“Own your identity. Embrace the legend. Be the bear.”

This wasn’t just art. This wasn’t just a marketplace. It was something more—an immortal digital mythology, an idea that refused to be confined to any one medium .

A new chapter was beginning.

And the Surrealist Bear? He was ready to write it.

You start your IKIGAI journey by minting a Genesis NFT—limited edition ERC-721 tokens packed with perks. These aren't just collectibles; they unlock actual vested rewards in IKIGAI tokens over 90 days. Imagine holding a rare piece of digital art that steadily earns you tokens each second you hold it. And the rarer your NFT, the richer the rewards. Legendary, Rare, Uncommon, or Common—each tier offers different incentives and benefits, like exclusive vault access and boosted yields.

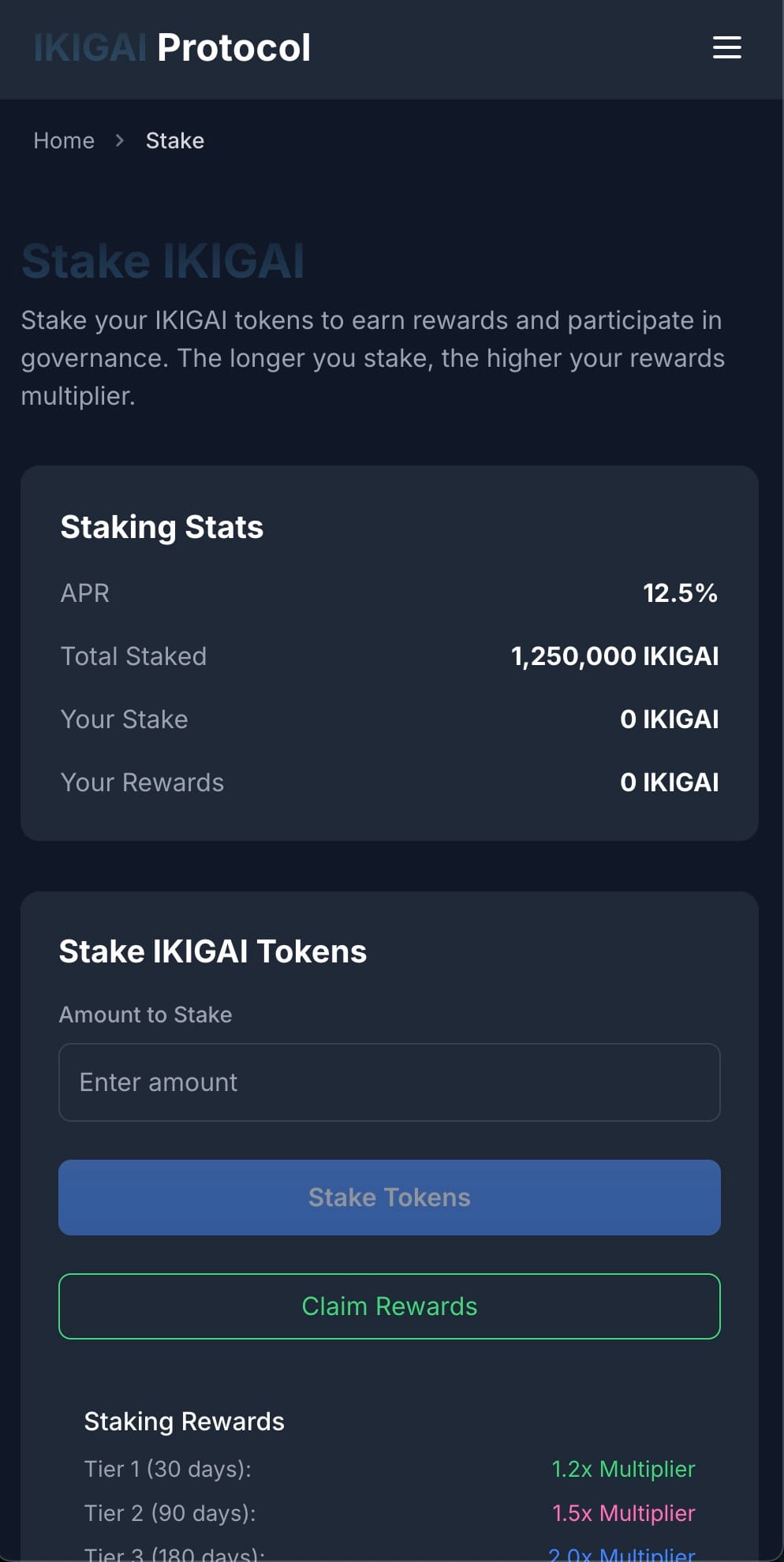

Once you're holding that shiny new NFT, what's next? Staking it, of course! IKIGAI’s NFT staking is where your digital art becomes even more valuable. Stake your NFT and watch additional IKIGAI tokens flow into your wallet, calculated precisely based on rarity and how long you stake. It's a win-win—more tokens, more influence, and more opportunities to dive deeper into the ecosystem.

Yield optimization is at the heart of IKIGAI. Imagine depositing your crypto assets into specialized Yield Vaults, each designed with its own smart strategy for maximum profit. These vaults auto-compound your yields, ensuring your investment continuously grows. Better yet, performance fees collected from these vaults aren't just pocketed by the protocol—they're reinvested into treasury growth, protocol-owned liquidity, and community rewards. This smart fee structure keeps the ecosystem vibrant, healthy, and lucrative for everyone involved.

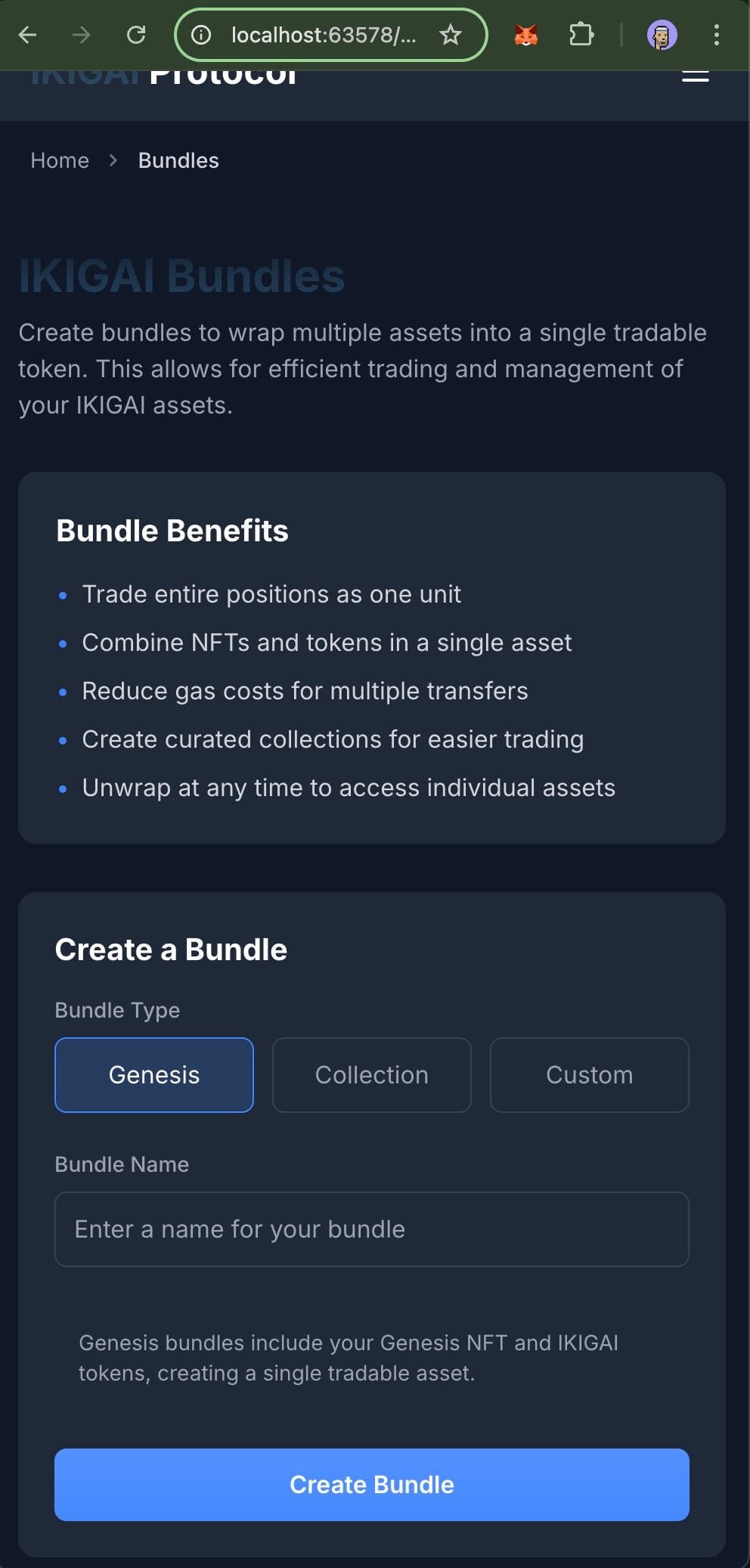

But the real innovation lies in IKIGAI's Strategy Bundles. Picture this—you can package multiple high-performing yield positions into a single, tradable token. Now your personalized yield strategies become community-shared financial instruments. Every time someone uses your bundle, you earn fees, transforming passive yield farming into active income creation. It’s like creating your own financial product without needing a Wall Street corner office.

The IKIGAI token itself (ERC-20) fuels this vibrant ecosystem. With a fixed supply of one billion tokens, it supports governance, staking, and rewards distribution. Holders aren't just passive observers—they actively shape the future of IKIGAI. Staking tokens unlocks multipliers for higher yields, fee discounts, and premium vault access. With clear incentive tiers, holding and staking IKIGAI becomes a no-brainer for serious DeFi enthusiasts.

Community governance powers the entire IKIGAI Protocol. If you hold at least 100,000 IKIGAI tokens, you’re empowered to propose changes—anything from adjusting fees to adding new strategies or managing treasury allocations. Every token equals a vote, aligning community interests and protocol success. It’s decentralization at its best.

Revenue from the IKIGAI strategies is thoughtfully redistributed: 46.5% bolsters protocol-owned liquidity, 30.2% goes back into yield rewards, and the remaining 23.3% sustains treasury operations. Protocol-owned liquidity itself is strategically allocated, securing IKIGAI/wBERA liquidity for stability and market confidence.

Security is not an afterthought—it's embedded deeply into IKIGAI’s DNA. With role-based permissions, emergency pauses, timelocks, and rigorous audits, the protocol prioritizes safety as much as profitability.

So whether you're minting Genesis NFTs, creating strategy bundles, staking for yield and governance, or engaging with a community dedicated to innovation and security—IKIGAI Protocol on Berachain has something unique for everyone.

IKIGAI Token Distribution

The IKIGAI Protocol has carefully designed its tokenomics to maximize community engagement, growth, and sustainability. With a fixed supply of 1 billion tokens, IKIGAI’s distribution strategy emphasizes rewarding active participation and ensuring long-term protocol health:

- Genesis NFTs: 40% (400 million tokens)

- Yield Rewards: 35% (350 million tokens)

- Community/DAO: 15% (150 million tokens)

- Treasury: 10% (100 million tokens)

Token Specifications

- Name: IKIGAI Token

- Symbol: IKIGAI

- Decimals: 18

- Total Supply: 1,000,000,000 (1 billion)

- Contract Standard: ERC-20 with Permission Extensions

- Initial Supply: 0 (Fair Launch Model)

Token Vesting & Emission Schedule

Genesis NFT Vesting (40% of Total Supply)

Genesis NFTs unlock token rewards through a 90-day linear vesting schedule. Tokens are steadily released each second over the vesting period, encouraging long-term holding and ecosystem participation:

- Legendary Tier: 100,000 IKIGAI per NFT

- Rare Tier: 50,000 IKIGAI per NFT

- Uncommon Tier: 25,000 IKIGAI per NFT

- Common Tier: 10,000 IKIGAI per NFT

Staking Rewards Emission (35% of Total Supply)

NFT holders further benefit from staking, receiving time-based IKIGAI rewards tailored to the rarity and duration of staking:

- Base Reward: 10 IKIGAI per year per staked NFT

- Custom Reward Rates: Enhanced rewards for higher-tier NFTs and special editions

- Time-Weighted Rewards: Longer staking periods yield progressively higher rewards

Yield Strategy Performance Rewards

The protocol incentivizes ongoing participation by rewarding additional IKIGAI tokens derived from yield strategy performance:

- Performance fees totaling 4.3% are collected from yield strategies:

- 2.0% allocated to Protocol Owned Liquidity (POL)

- 1.3% redistributed as yield rewards

- 1.0% directed toward treasury operations

Token Utility Model

The IKIGAI token serves multiple critical roles within the ecosystem:

Protocol Governance

- Proposal Submission: Requires a minimum of 100,000 IKIGAI tokens

- Voting Weight: 1 IKIGAI token equals 1 vote

- Governance topics include adjusting protocol parameters, introducing new strategies, modifying fees, and managing treasury allocations.

Economic Incentives

- Fee Discounts:

- 10,000 IKIGAI: 10% fee reduction

- 50,000 IKIGAI: 25% fee reduction

- 100,000 IKIGAI: 40% fee reduction

- 250,000 IKIGAI: 60% fee reduction

- Yield Boosters:

- Users can boost vault APY by staking IKIGAI

- Multiplier formula: 1 + (stakedAmount / 10,000) * 0.5 (maximum boost capped at 2.5x)

Access and Premium Features

- Vault Access Levels:

- Public Vaults: Open to all

- Premium Vaults: Require staking of 50,000 IKIGAI

- Elite Vaults: Require staking of 250,000 IKIGAI

- Strategy Bundle Creation:

- Minimum stake of 25,000 IKIGAI required to create bundles

- Bundle creators earn 20% of the fees generated from bundle usage

Protocol Revenue Allocation

Protocol revenue is derived from strategic performance fees, which sustain growth and enhance liquidity:

- Protocol Owned Liquidity (POL): 46.5%

- Yield Rewards: 30.2%

- Treasury Operations: 23.3%

Protocol Owned Liquidity Mechanism

Revenue allocated to POL is strategically used:

- 75% locked into IKIGAI/BERA liquidity pools for 2 years

- 25% maintained as a strategic reserve, controlled via community governance

Performance Fee Structure

Performance fees ensure sustainable growth and reward excellence:

- Base Fee: 2% of generated yield

- Performance Fee: Additional 2.3% on yield above the quarterly adjusted hurdle rate (Risk-free rate + 2%)