Just as an artist transforms a blank canvas into a masterpiece, DeFi has given rise to creative solutions, reimagining the financial landscape. It paints a novel picture, merging the abstracts of finance with the dynamism of community-led governance. Imagine OHM as an artwork, with its value not determined by a fixed frame of reference, but influenced by an underlying collection of assets, similar to how an artwork's value can be derived from an artist's entire oeuvre. Unlike traditional stablecoins, OHM's value is not pegged, but rather backed by these assets held in the Olympus treasury. This unique structure imparts a form of 'fluid stability', a fluctuating value with a theoretical floor. OlympusDAO retained a substantial portion of its own tokens, similar to an artist keeping works in their own collection. Just as the art world grows and thrives through bold experiments and pioneering creators, Olympus DAO’s journey, marked by its ingenious strategies and response to criticism, serves as a profound narrative in the DeFi artistry. (video)

2021 Gold Rush

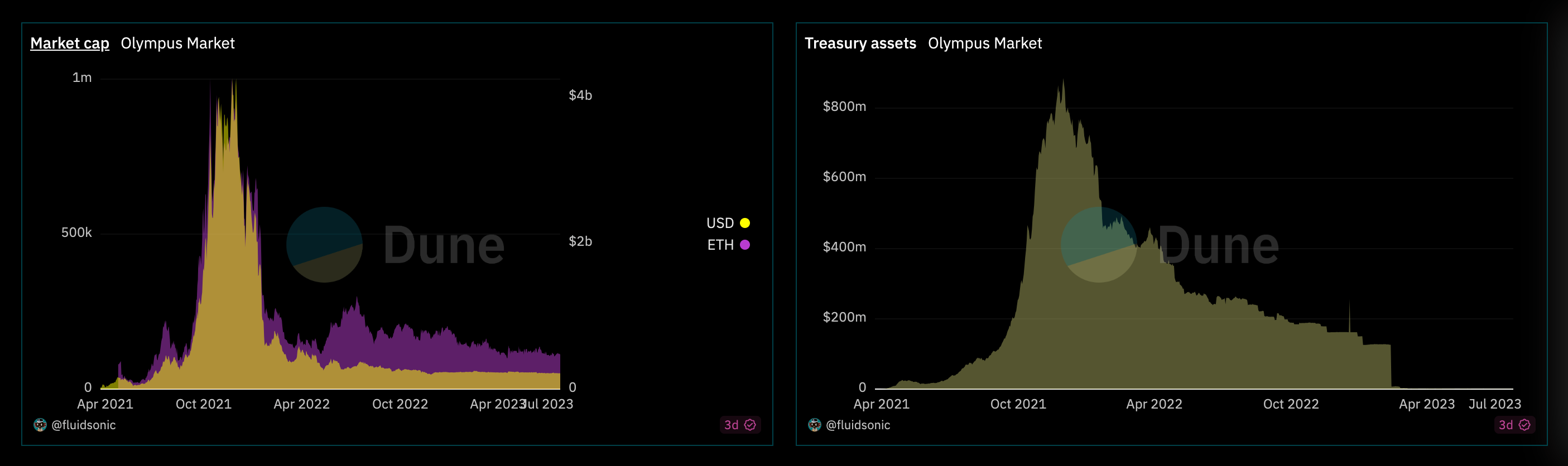

"But how are they going to get this party started?" you might ask. Olympus used a system called "bonding" to bootstrap capital. Basically, it allowed users to buy OHM at a cheaper rate than the market, hold onto it for a bit, then later get the full price worth. It's like a gift card that pays you back more than you paid for it. By selling OHM cheaper than it was in the open market, Olympus could pool funds from users in exchange for minting new OHM, growing their piggy bank in the process. It's like they had their own mini reserve bank! To make OHM as irresistible as a croissant, they offered jaw-dropping APY returns for staking OHM. The catch? The more OHM you stake, the more you get in return, but with much more OHM in the system. Many investors staked their OHM within the protocol, locking up a large portion of the asset supply, driving up demand, and supporting the price.

(CC1) Olympus DAO came up with a decentralized alternative to stablecoins.

They filled their coffers through a clever bonding system, and they tempted investors with high APY returns for staking their OHM. The end goal? To create a stable, widely accepted currency for the DeFi world. (video)

Few DeFi protocols have sparked as much intrigue as OlympusDAO. With a legion of fervent followers, commonly known as Ohmies, its (3,3) meme has become a widespread phenomenon. After a meteoric rise culminating in a peak at the end of November, however, detractors have come forward to claim that the hype has met its end and that the underlying structure has been laid bare.

The remarkable yields grabbed attention and stirred interest in OHM, similar to a controversial art performance inviting critical dialogues and public attention. Early adopters of OHM were rewarded with returns akin to acquiring a now-celebrated artwork in its nascent stages. However, these yields also attracted criticism, leading to complex debates and discussions reminiscent of the controversies that often surround avant-garde art.

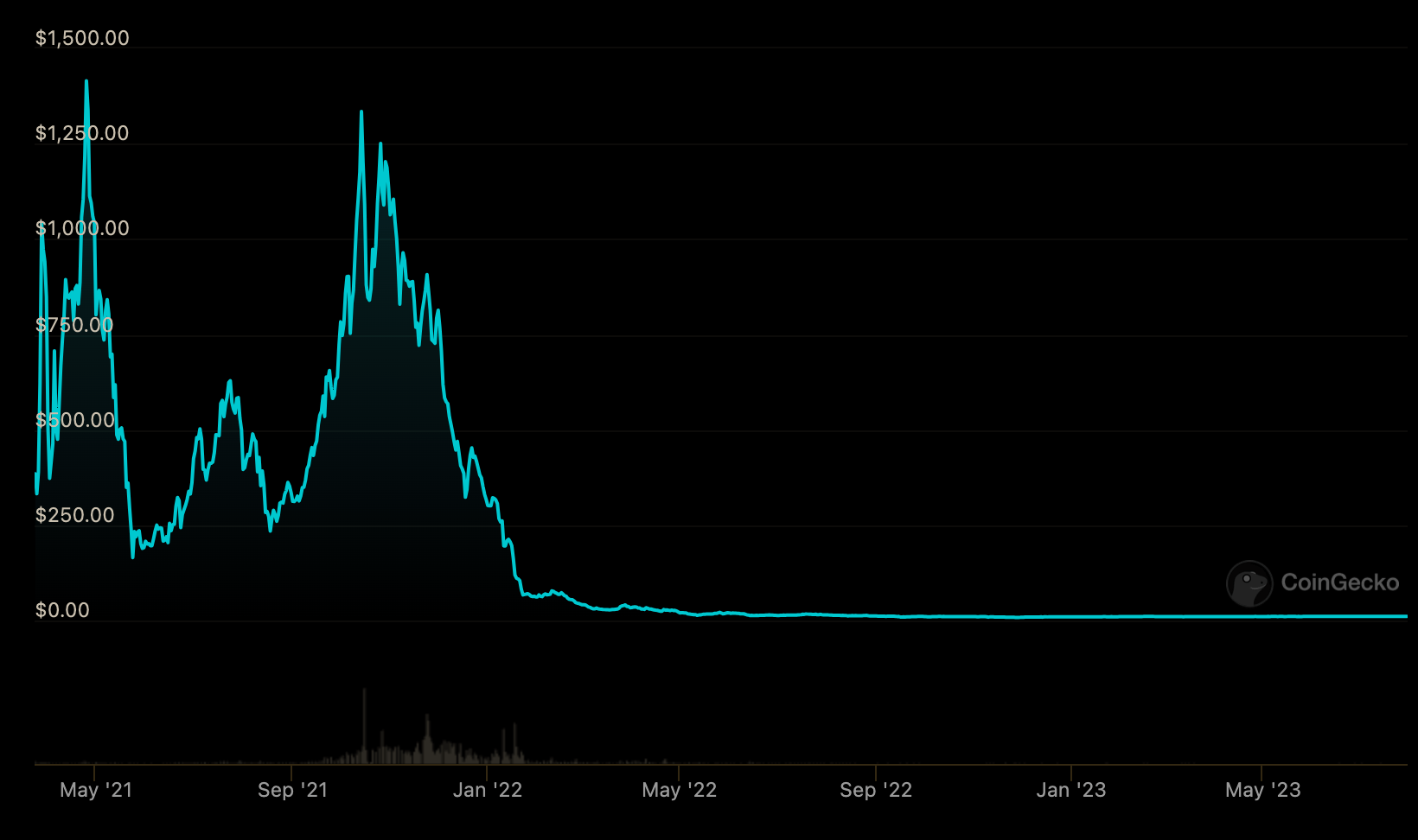

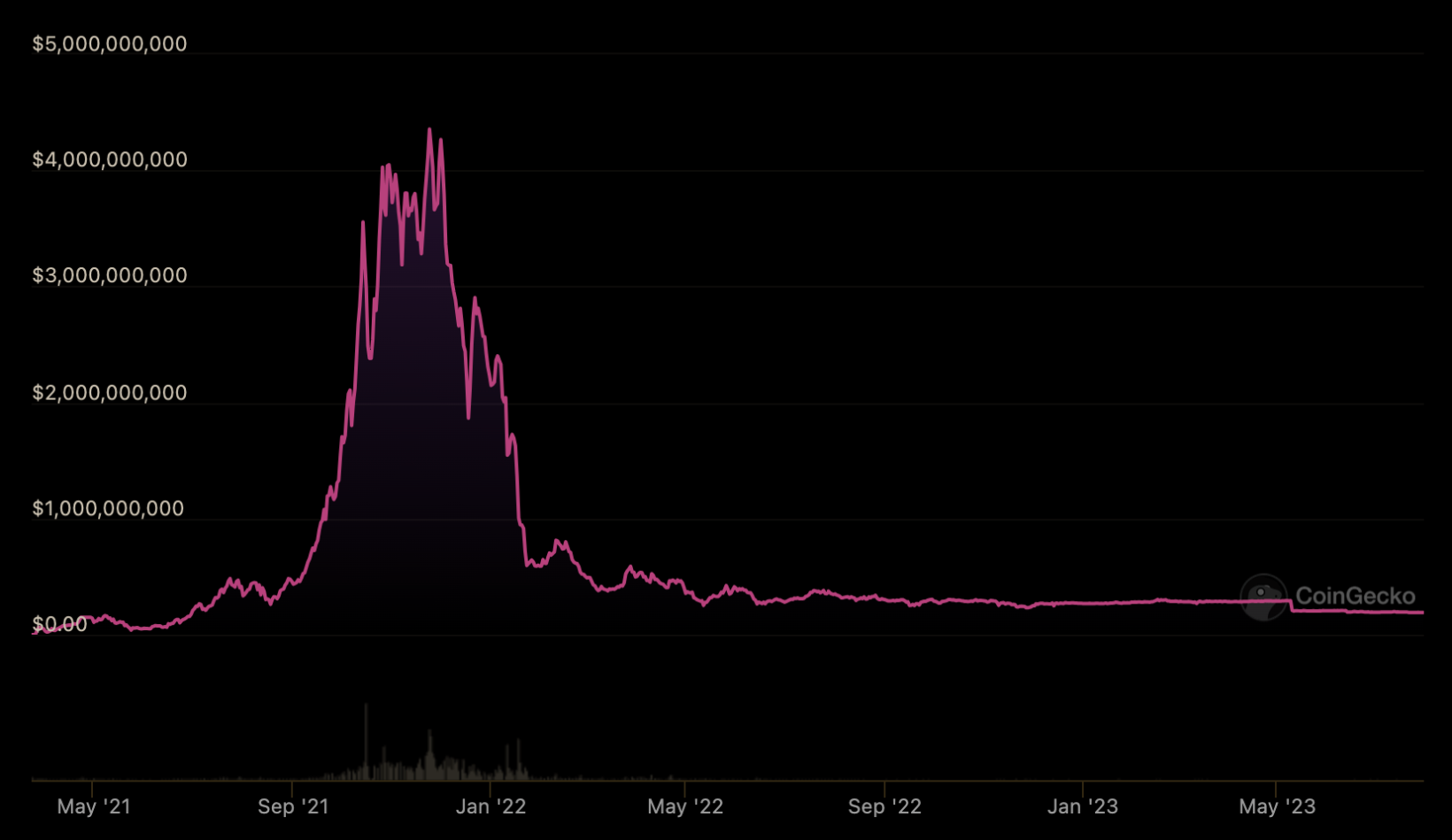

The high Annual Percentage Yield (APY) offered on staked OHM acted as a magnetic pull for investors. Some observers argue that the attractive returns might have misled less-informed investors. Nevertheless, proponents of Olympus DAO suggest that these high APYs were part of a larger strategy to boost OHM's demand, hence contributing to liquidity. Regardless of the sustainability concerns, early investors in OHM reaped extraordinary returns. Some benefited from astronomical APYs over a few months, and the price of OHM surged from $250 to over $1250+ per OHM.

Now try doing the math on what APY you need on your $1 token to ever get back your $1000 and take into account the APY keeps going down at an uncertain rate.

There was a decent amount of FUD around pOHM, as for every $1m of market cap into OHM, pOHM investors get $118,000 cut off the top. Since pOhm costs $1 to exercise, it is actually better to sell it before the price gets diluted. If Ohm converges to $1, they actually end up being worthless pOhm call options.

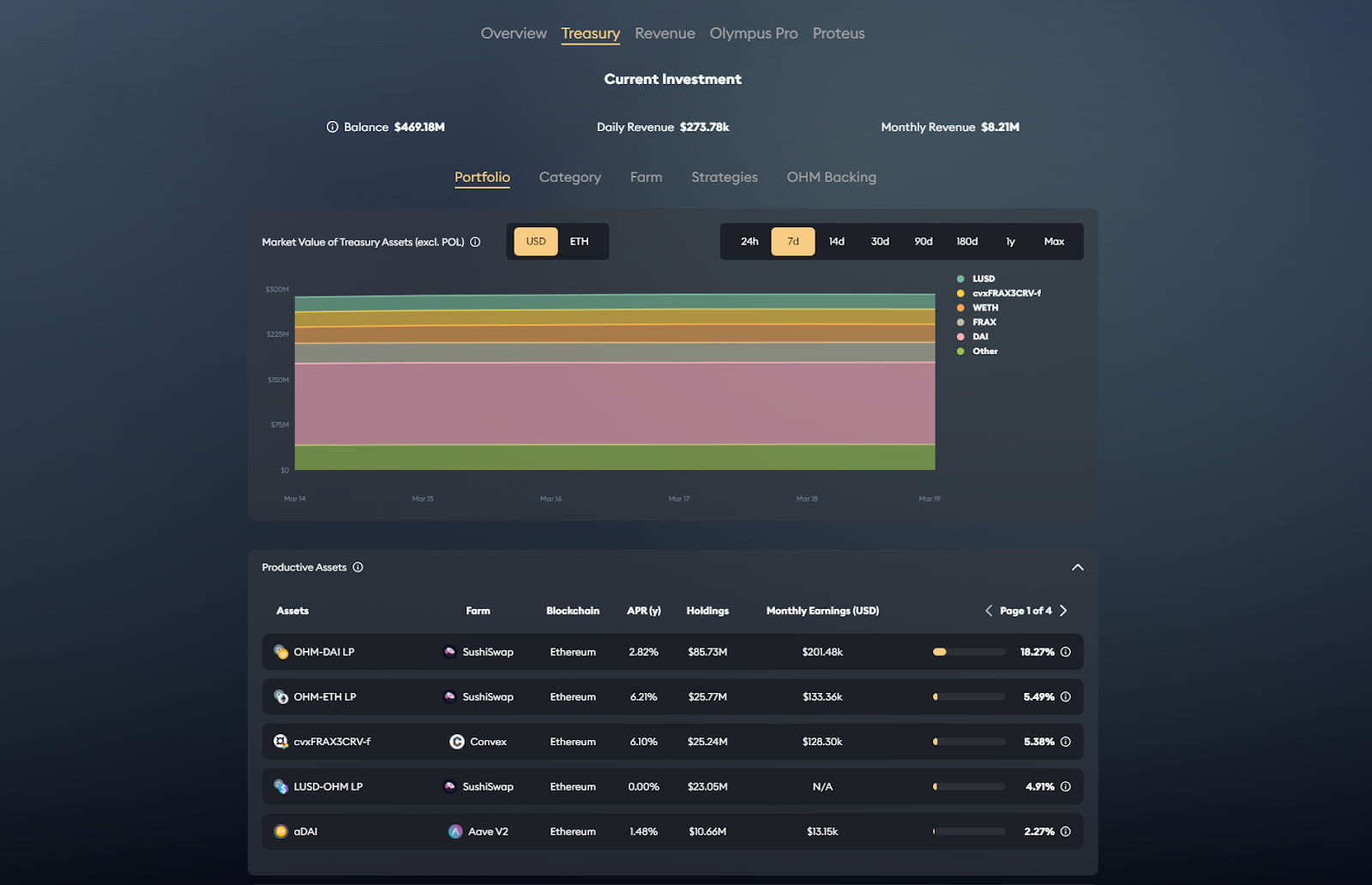

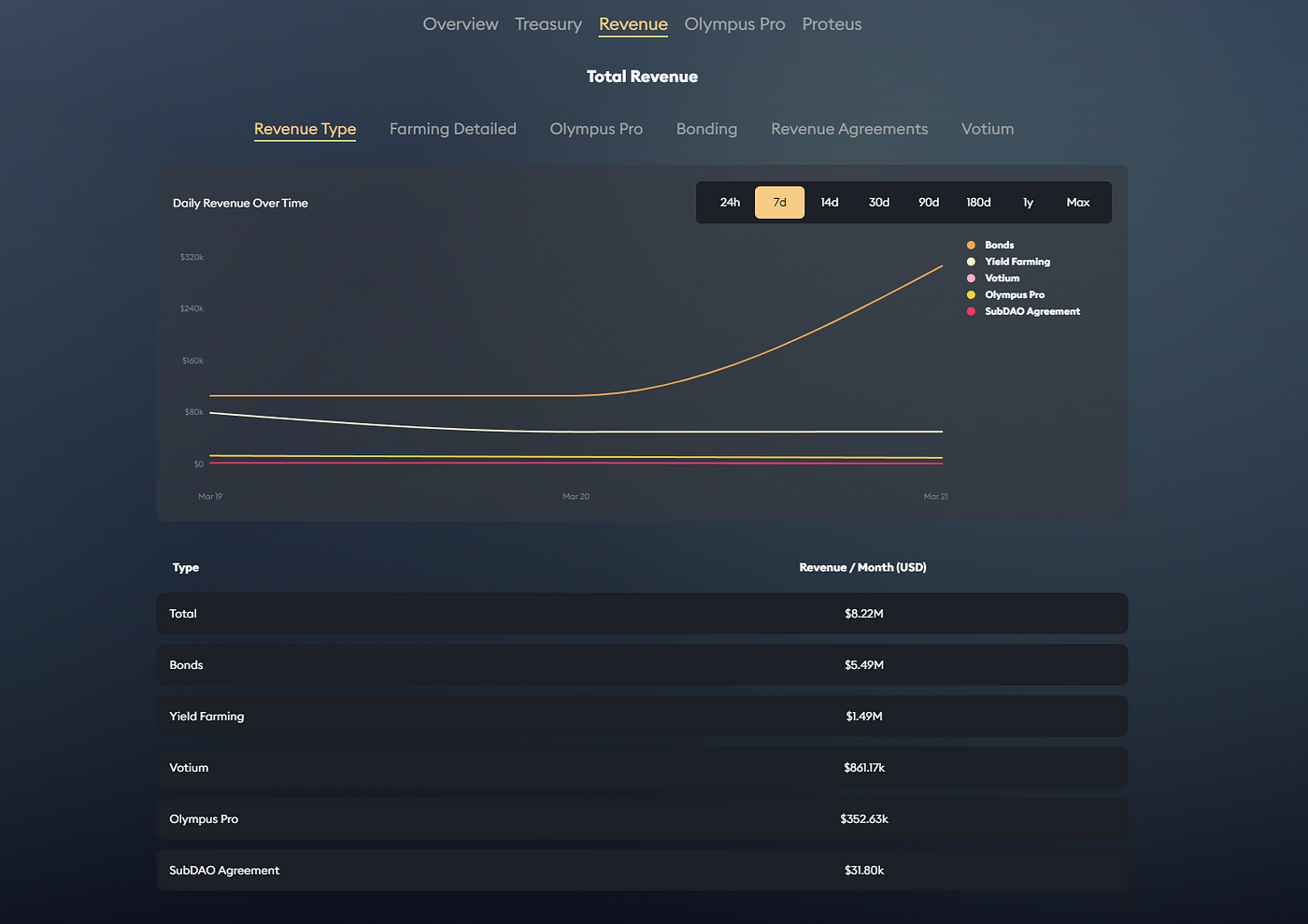

The pathway for Olympus DAO to transition from its growth phase and successfully establish itself as a decentralized reserve currency for Web3 became uncertain. It will depend largely on the DAO's capacity to efficiently manage its treasury and continue its growth initiatives. The protocol (150 contributors at ATH, 25 today) forged partnerships to enhance OHM's integration and reach.

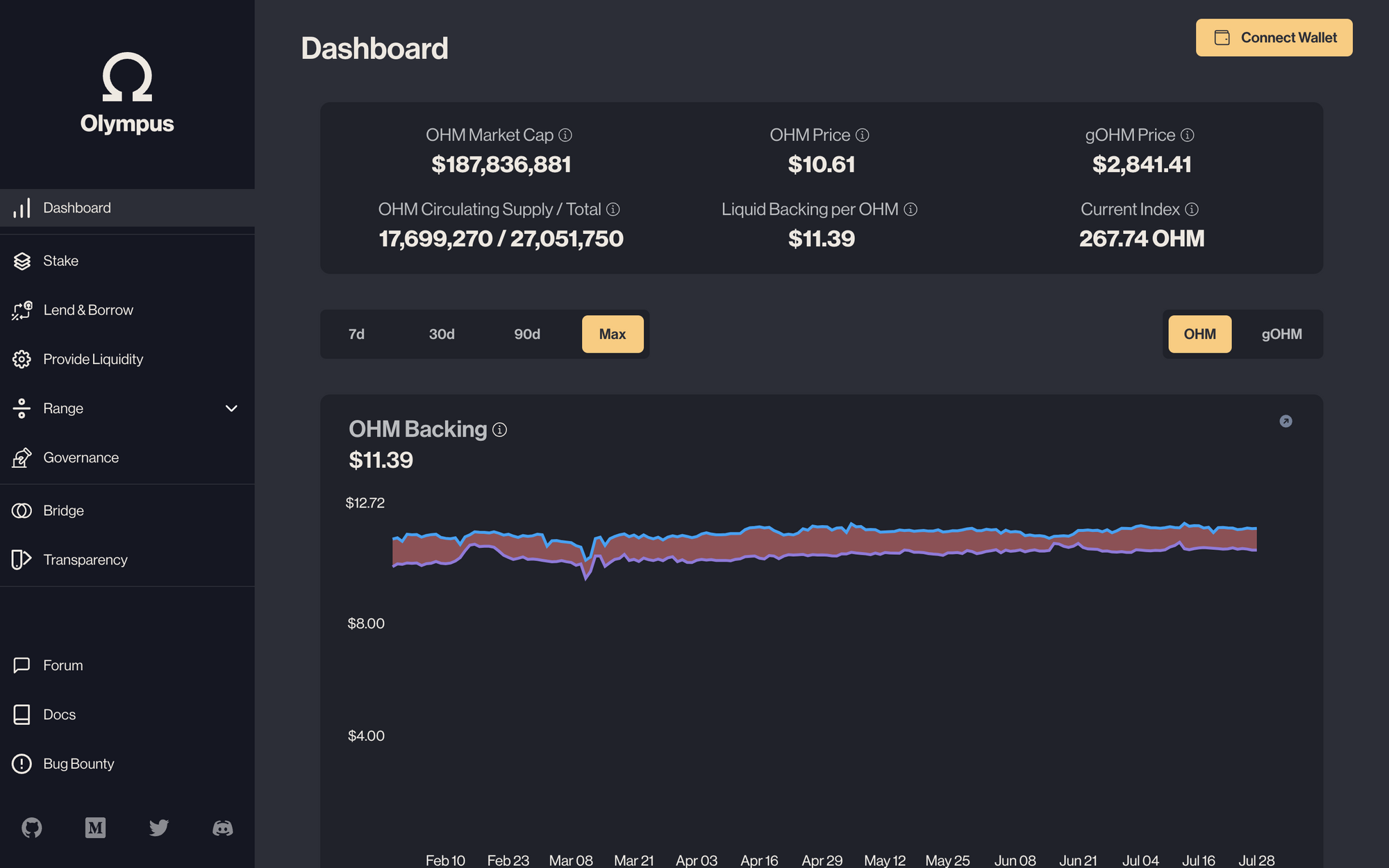

2022 Max Pain

Despite these advancements, we can't overlook the monumental decline in OHM's price since its inception. This nosedive burnt numerous investors, many of whom feel duped by the allure of high APYs. However, it's important to note that this price drop was largely anticipated as part of the protocol's design. In the initial stages, speculation was both anticipated and necessary for growth. As Olympus DAO scaled, the speculative aspect was expected to diminish, and the OHM price would converge toward its backing. The question remains whether investors fully understood this dynamic. It's a precarious balancing act, given that Olympus DAO's success heavily relies on the collective belief of the ecosystem's participants. If the initial supporters' trust dwindles and they choose to distance themselves permanently, the project's future could be at risk.

When there's confusion, disillusionment, and criticism, there's also chaos from which invaluable lessons emerge.

The Olympus DAO system operates based on game theory, where the actions of each player impact others, emphasizing mutual cooperation for optimal results. However, investors prioritizing short-term gains and reacting impulsively under pressure found themselves in a mutually detrimental position.

Following this, Olympus DAO had two options to compensate investors with its remaining treasury. They could either execute a 'Buyback' – purchasing their own tokens to increase the market value and minimize losses, akin to an artist buying back their artwork. Alternatively, they could distribute remaining funds to token holders via an 'Airdrop,' mirroring the process of redistributing unsold art pieces to patrons. The fragility of the system has been exposed, causing many investors to withdraw their liquidity. Just as the art market fluctuates based on global economic conditions, the viability of protocols like Olympus DAO and its derivatives are closely tied to the overall state of the crypto market. Their sustainability during bearish market conditions remains a significant concern.

We are continuously intrigued by the intersections of creativity, technology, and finance. There is an undeniable excitement, a frisson of something new and transformative when these spheres interact. Much like the artists we admire and feature, the creators of OlympusDAO dared to innovate, shatter conventions, and reimagine possibilities. The OlympusDAO story offers striking parallels to the art world, making it an ideal case study for our exploration into DeFi.

Let's remain open and curious, drawing insights from these parallels and recognizing the synergies in these seemingly disparate worlds. OlympusDAO, like an influential artwork, reflects and shapes its epoch. It stands as an exciting symbol of the New Renaissance, a confluence of art, technology, and finance.

After all, isn't that what the art world cherishes - the ceaseless pursuit of innovation, transformation, and the promise of a more nuanced future?

2023 Key initiatives

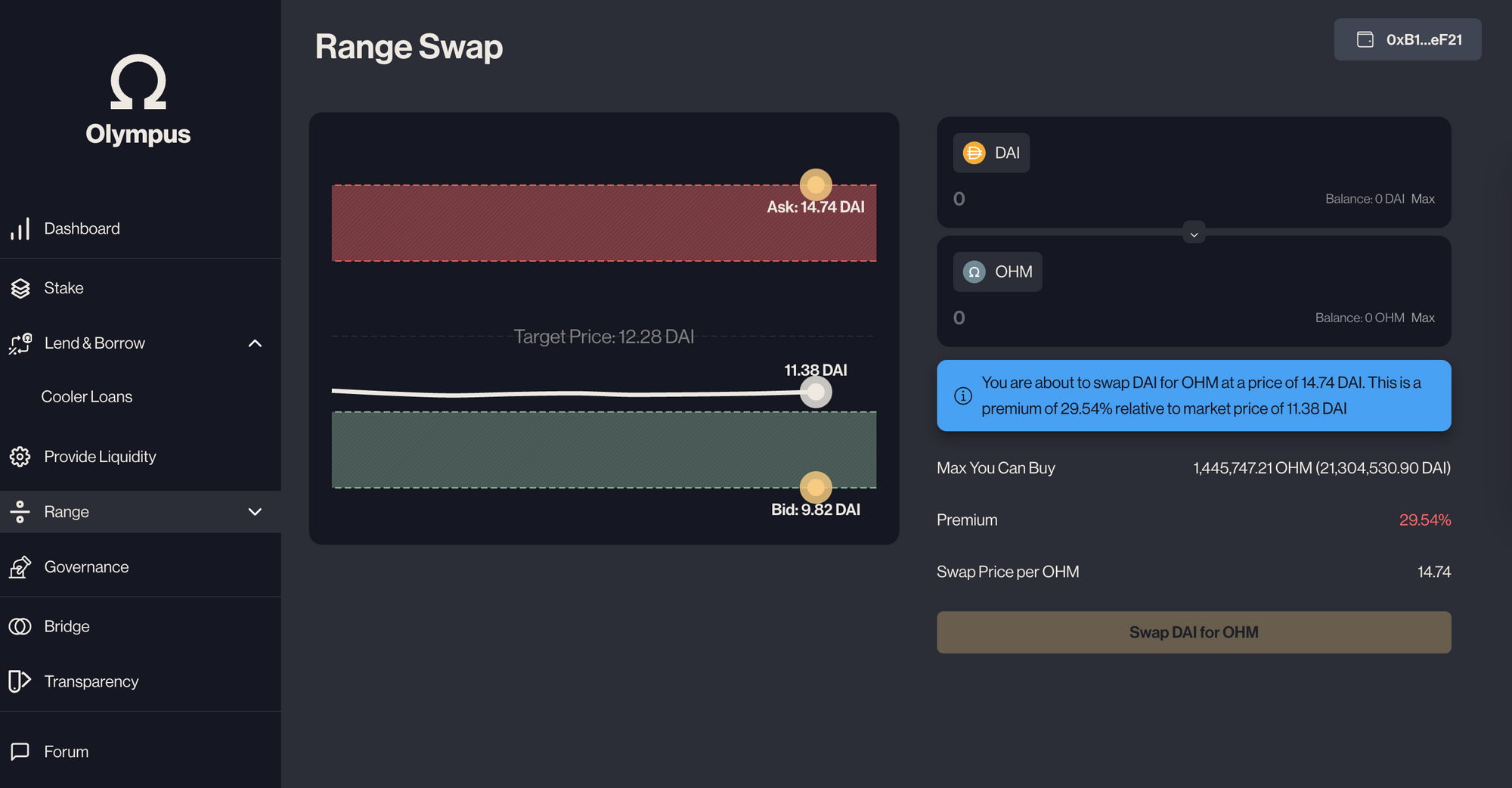

Includes an Emissions Framework to track all the ways the protocol emits OHM and an Automated Emissions Controller that implements this framework through a smart contract. There is also focusing on OHM Bonds, On-Chain Accounting, and Range Bound Stability (RBS) v2 to further stabilize OHM's volatility. OlympusDAO has also completed projects to allow cross-chain OHM and access to L2 markets.

The organization's vision is defined by principles of creating a decentralized reserve currency using smart contracts, maintaining transparency and integrity, and fostering community involvement in decision-making processes. These guidelines serve to navigate the future growth and development of OlympusDAO.

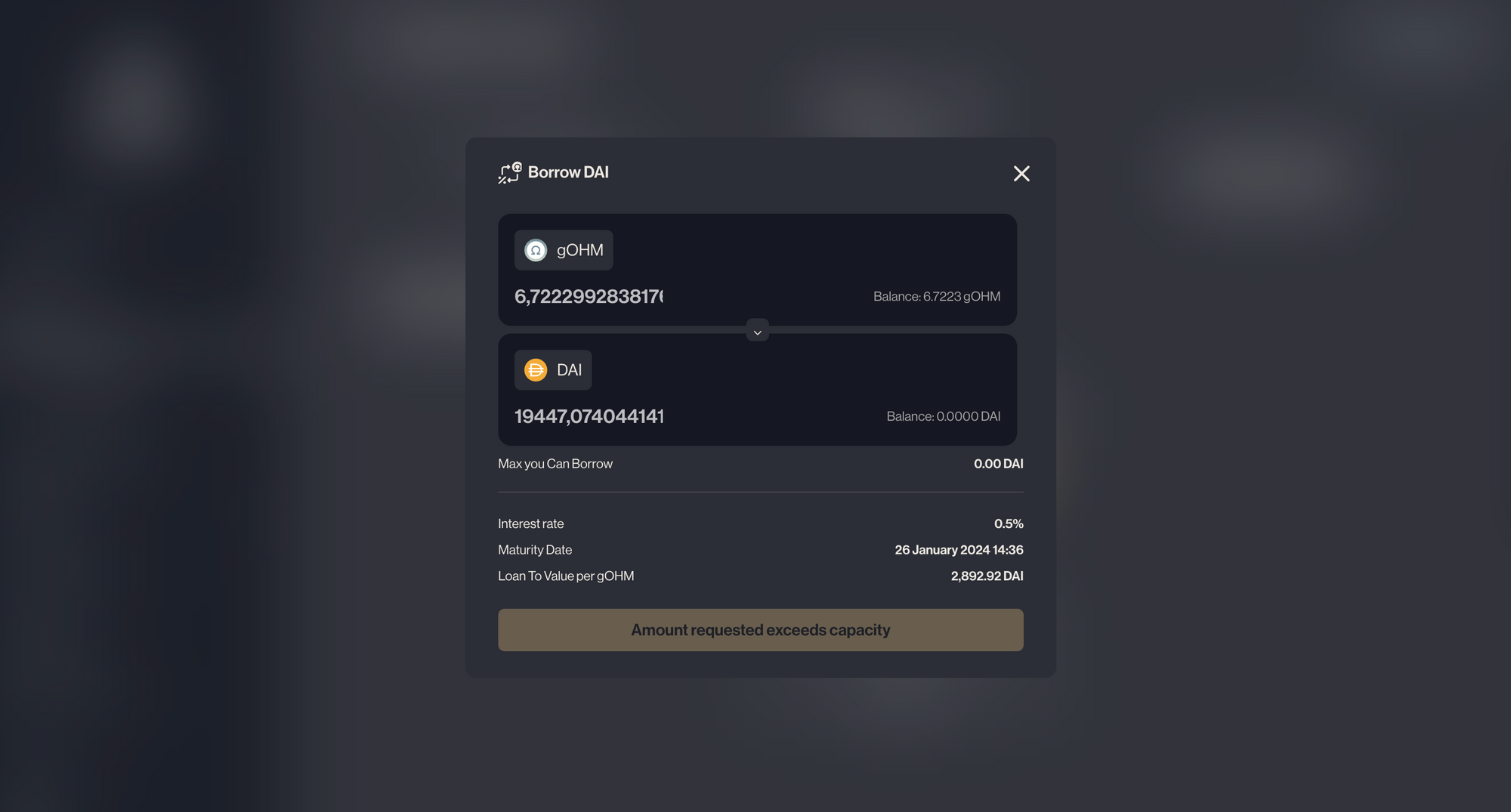

2024 Cooler Loans

The process is simple: you decide the loan amount, the item you're pledging as collateral, the interest you're willing to pay, and the payback time. If another person agrees to these terms, they lend you the money and take a soft hold on your collateral, which stays securely in the Cooler. You're free to repay the loan at any time, and doing so returns your collateral. However, failing to repay in time transfers the ownership of the collateral to the lender. This intuitive system makes it easier to borrow and lend money without constantly monitoring market prices or worrying about sudden changes in your collateral's value. Everything is predetermined, with changes happening only if you default on your loan. Recently, a significant proposal has surfaced that seeks to utilize this Cooler Loans concept on a larger scale.

While this may simplify and decrease the risk associated with the treasury, further steps need to be taken to address the operational, regulatory, and smart contract risks associated with the protocol. The DAO believes that full protocol automation and autonomy, along with the implementation of on-chain governance, will minimize these associated risks and bolster OHM's chances of becoming a reserve currency. By January 2024, the aim is to minimize human intervention in the protocol's operation, enabling anyone to propose code upgrades and build on top of Olympus. The system is designed to be Cooler-compatible and will remain in a "dormant state" until a certain threshold of total supply is deposited into the voting contract. (forum)