Addressing the operational and motivational aspects of transitioning an open-source NFT marketplace into a DAO-led entity involves a multifaceted approach. It requires careful planning and the implementation of structures that ensure continuous development, business management, and incentivization for long-term commitment. Here’s how these challenges can be met:

Sustaining Development and Operations

- Contributor Incentive Programs: Implementing structured incentives for developers and operational staff is crucial. This can include token-based compensation, which aligns their interests with the success and growth of the DAO. Such tokens could appreciate in value, offering long-term rewards for early and ongoing contributions.

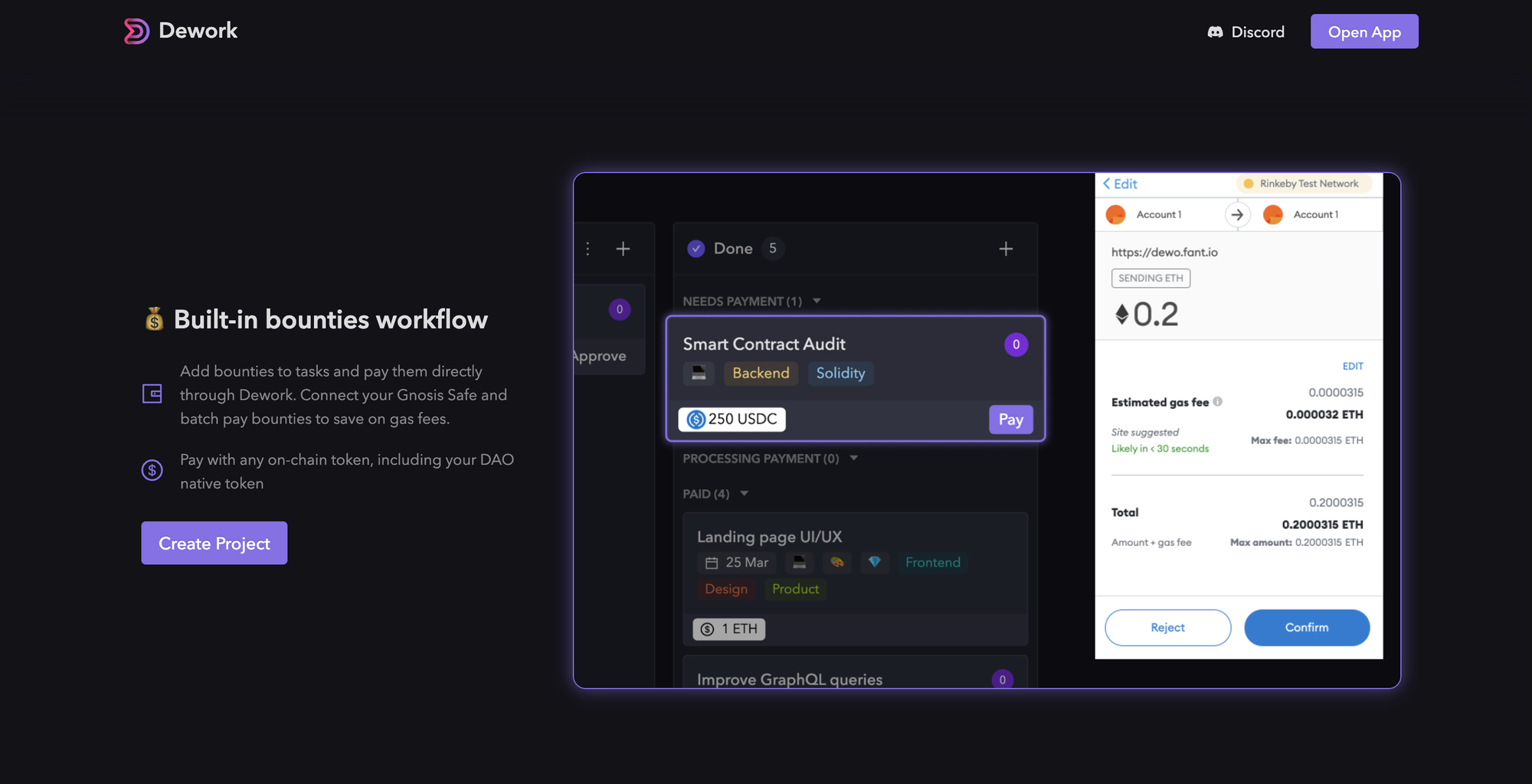

- Bounty and Grant Systems: For specific projects, tasks, or enhancements, the DAO can establish bounty and grant programs. These programs can attract talent from the community and beyond, ensuring that the platform continues to evolve and innovate.

- Open-Source Collaboration: Leveraging the open-source model, the marketplace can encourage contributions from a wide range of developers. This can be facilitated through platforms like GitHub and Dework, where tasks are openly listed and contributors are rewarded for their submissions.

- Decentralized Autonomous Teams (DATs): Creating smaller, autonomous teams within the DAO for specific functions (development, marketing, customer support) can streamline operations. These teams can operate with a degree of independence, guided by the overarching goals and governance of the DAO.

Running the Business Side

- Tokenomics and Financial Sustainability: Designing a robust token economy is essential for financial health. This includes mechanisms for generating revenue, such as transaction fees, premium listings, and services, which can be reinvested into the DAO for growth and development.

- Governance and Decision-Making: Implementing a transparent and efficient governance structure is key to managing the business side effectively. This might involve the use of DAO governance platforms that facilitate proposal submission, voting, and implementation, ensuring that decisions are made in the best interest of the community.

- Legal and Regulatory Compliance: Partnering with legal experts and advisors who understand the evolving landscape of blockchain and DAOs can help navigate compliance issues, especially regarding token sales, intellectual property rights, and operational transparency.

Ensuring Long-term Dedication and Focus

- Vesting Schedules and Lock-up Periods: For contributors receiving tokens as part of their compensation, implementing vesting schedules and lock-up periods can ensure long-term commitment. This means that contributors would receive their rewards over time, incentivizing sustained contribution and engagement.

- Reputation Systems and Non-Financial Rewards: Incorporating reputation systems and non-financial rewards (such as unique NFT badges for significant contributions) can provide recognition and status within the community, fostering a sense of belonging and motivation beyond financial incentives.

- Community and Culture Building: Cultivating a strong community culture that values transparency, innovation, and collaboration is vital. Regular community events, AMAs (Ask Me Anything sessions), and forums for sharing ideas can keep the community engaged and focused on shared goals.

- Continuous Learning and Growth Opportunities: Providing opportunities for community members to learn and grow, such as access to educational resources, workshops, and mentorship programs, can help maintain high levels of engagement and dedication.

By implementing these strategies, the DAO can maintain a vibrant ecosystem of contributors who are financially incentivized, culturally invested, and dedicated to the long-term success and innovation of the NFT marketplace. The evolution of a DAO, from its inception to a fully mature organization, encounters several challenges that can hinder its growth and effectiveness. These challenges include inefficiencies in on-chain governance, such as low participation rates in voting and the complexities involved in coordinating large-scale, decentralized decision-making processes. Decentralized Autonomous Teams (DATs) emerge as a strategic innovation to address these issues, enhancing the DAO's operational efficiency and engagement throughout its lifecycle.

Addressing DAO Challenges with DATs

- Enhanced Focus and Specialization: As DAOs expand, the breadth of tasks and decisions required can overwhelm the collective governance model. DATs allow for the segmentation of these responsibilities into more manageable, focused areas. Each team can concentrate on specific operational or development tasks, leveraging their expertise to make swift, informed decisions. This specialization not only increases efficiency but also ensures higher quality outcomes.

- Increased Engagement and Participation: A common issue faced by DAOs is the low participation rate in governance processes. This can be attributed to the broad scope of decisions required from members, many of which may not align with their interests or expertise. DATs provide a solution by enabling members to engage in areas that directly interest them or where they can contribute meaningfully. This targeted engagement fosters a more active and committed community.

- Scalability and Flexibility: As DAOs grow, the need for scalable and flexible governance models becomes critical. DATs offer a modular approach to governance, where autonomous teams can be dynamically formed, restructured, or disbanded based on the DAO's evolving needs. This adaptability is crucial for the DAO to remain responsive to new challenges and opportunities.

- Experimentation and Innovation: DATs create an environment conducive to experimentation and innovation. By operating autonomously, these teams can explore novel ideas, governance models, and solutions with greater freedom and less risk to the DAO as a whole. Successful experiments can then be scaled and integrated across the DAO, driving continuous improvement and innovation.

- Mitigating Centralization Risks: One of the paradoxes of DAO governance is the risk of centralization, where a small group of highly active or influential members may dominate decision-making. DATs mitigate this risk by distributing governance across multiple, autonomous teams, each with its own leadership and accountability mechanisms. This distribution of power aligns with the foundational principles of decentralization that underpin DAOs.

DATs: The Path Forward for Effective DAO Governance

Integrating DATs into the DAO lifecycle represents a strategic evolution of decentralized governance, addressing key operational and engagement challenges. This model respects the principles of decentralization while introducing the efficiency, specialization, and engagement necessary for the DAO's sustained growth and success. By fostering a more dynamic and participatory governance structure, DATs can significantly enhance the resilience and adaptability of DAOs, ensuring their relevance and impact in the evolving landscape of decentralized organizations.

Implementing a Decentralized Autonomous Team (DAT) structure with specific roles for creators, curators, and collectors within a DAO, utilizing smart contracts with advanced features such as anti-bot measures, automatic liquidity addition, and fee redistribution, requires a multifaceted approach. These smart contracts serve not just as a transactional backbone but also as a governance framework that aligns with the operational and incentive mechanisms of each DAT. Here's how it could be achieved:

Structuring the DATs with Smart Contracts

- Creator DAT: This team focuses on the creation and contribution of new digital assets to the marketplace. The smart contract for the Creator DAT would manage the distribution of rewards from transaction fees to creators, incentivizing the production of high-quality content. This contract could include functions to ensure creators receive a percentage of sales or resales, in line with the "creator rewards" fee structure.

- Curator DAT: The Curator DAT is responsible for maintaining the quality and relevance of the assets in the marketplace. Through the smart contract, curators could be rewarded for their efforts in selecting, verifying, and promoting content within the platform. This contract might include voting mechanisms for curators to decide on featured assets or collections, with curator rewards being distributed based on their participation and impact.

- Collector DAT: The Collector DAT would encompass the community of buyers and supporters of the digital assets. The smart contract for collectors could implement mechanisms for rewards based on holding periods, participation in DAO governance, or contributions to the platform's liquidity. Collector rewards would encourage long-term holding and active participation in the ecosystem.

Implementing Advanced Contract Features

- Anti-Bot Measures: To protect the integrity of the marketplace and ensure fair participation, the smart contracts would implement cooldown periods between trades and maximum transaction limits. This would prevent price manipulation and ensure that the actions within the DATs are aligned with the long-term health of the platform.

- Automatic Liquidity Addition: By automatically adding a portion of transaction fees to the liquidity pool on decentralized exchanges like Uniswap, the contracts ensure continuous liquidity and stability of the platform's native token. This is crucial for facilitating smooth transactions and maintaining user confidence.

- Fee Redistribution: The smart contracts would handle the dynamic redistribution of transaction fees. This includes:

- Reflection to all token holders to incentivize participation.

- Burning a percentage of tokens to reduce supply.

- Adding liquidity to the market to ensure stability.

- Distributing rewards to creators, curators, and collectors.

Governance and Operational Efficiency

The use of smart contracts to manage the operational aspects of the Creator, Curator, and Collector DATs ensures transparency, fairness, and efficiency. By automating rewards and participatory mechanisms, they can foster a vibrant, self-sustaining ecosystem that values and rewards all participants. Moreover, the inclusion of anti-dump mechanisms and fee distribution aligns the interests of individual DATs with the overall health of the DAO, ensuring that each action taken contributes positively to the ecosystem.

The incorporation of these smart contracts within the DAO cycles enhances the governance model by providing clear, automated processes for contribution and reward. This structure not only addresses common issues experienced with DAOs, such as low voting participation and governance overhead but also creates a more engaging and rewarding ecosystem for creators, curators, and collectors alike. Through this approach, the DAO can achieve a balanced, dynamic operation that drives continuous growth, innovation, and community engagement.

In the realm of cryptocurrency, consensus is not just a mechanism; it's the very currency of trust and value. Embracing the collective judgment of a decentralized community turns the traditional financial world on its head, offering a competitive advantage in a market where perception shapes reality.

Navigating the Decentralized Paradox of Crypto

The concept that the cryptocurrency economy is fundamentally built on consensus is a profound reflection of its unique nature within the broader financial landscape. This principle of consensus underpins not only the technical operations of blockchain networks but also the cultural and economic dynamics of the crypto market.

Bitcoin, as the pioneering cryptocurrency, exemplifies the power of consensus in maintaining a decentralized, trustless system. Despite the potential presence of malicious or unreliable validator nodes, the consensus mechanism ensures the integrity and resilience of the network. This model of decentralization through consensus is a foundational departure from traditional centralized systems, where trust is placed in specific entities or individuals.

The acknowledgment that much of the cryptocurrency space harbors elements of centralization highlights a nuanced reality. While the ethos of crypto champions decentralization, practical implementations often reveal a spectrum of centralization-decentralization. Yet, the operative mechanism remains distinctively consensus-driven, differing fundamentally from the control dynamics of conventional corporations.

In the realm of NFTs and broader crypto protocols, the role of community consensus in determining value, legitimacy, and relevance is especially pronounced. Without traditional metrics or established critics to define quality or worth, the crypto art market thrives on the collective judgment and enthusiasm of its participants. This consensus-driven model challenges conventional notions of value and artistic merit, underscoring the decentralized ethos of the space.

The example of CryptoPunks V1 versus V2 further illustrates how consensus, rather than objective standards or historical precedence, shapes market dynamics and perceptions of value. This phenomenon extends beyond NFTs to encompass the entire spectrum of crypto protocols, where market sentiment and collective belief rather than cash flows or fundamentals dictate the perceived value and success of a project.

This market behavior underscores a unique opportunity for individuals who immerse themselves in the crypto ecosystem. Understanding the intricacies of public perception and sentiment in crypto offers a competitive edge, enabling participants to navigate and potentially thrive in a market that confounds traditional financial logic. It highlights how, in the world of cryptocurrency, being deeply connected to the community's pulse can provide insights and advantages that elude even the most sophisticated traditional investors.