The allure of quick profits and the anonymity provided by blockchain technology have paved the way for a new breed of opportunists. These individuals, often referred to as "grifters," exploit the system's openness and lack of regulation to siphon value from the community, particularly through less technical projects like NFTs (Non-Fungible Tokens) and memecoins. This phenomenon poses a significant challenge, undermining trust and stalling innovation within the ecosystem.

The Easy Road to Extraction: NFTs and Memecoins

At the heart of the issue is the ease with which derivative projects can be launched. Memecoins, for instance, capitalize on internet culture and humor to create a buzz, but often lack substance or long-term utility. Similarly, the NFT space, while revolutionary in providing artists and creators with a platform to monetize their work, has also become a fertile ground for those looking to make a quick profit by flooding the market with low-effort, high-volume content.

The process is disturbingly straightforward: identify a rising trend within the crypto space, quickly develop a project that mimics the successful formula without the intention of delivering real value, and then market aggressively to capture a share of the investment flowing into the category. This strategy, although not technically classified as a scam due to the minimal effort to create a semblance of legitimacy, often results in a "slow rug," where the creators gradually withdraw from the project.

The Technical Barrier: L2 and DeFi's Immunity

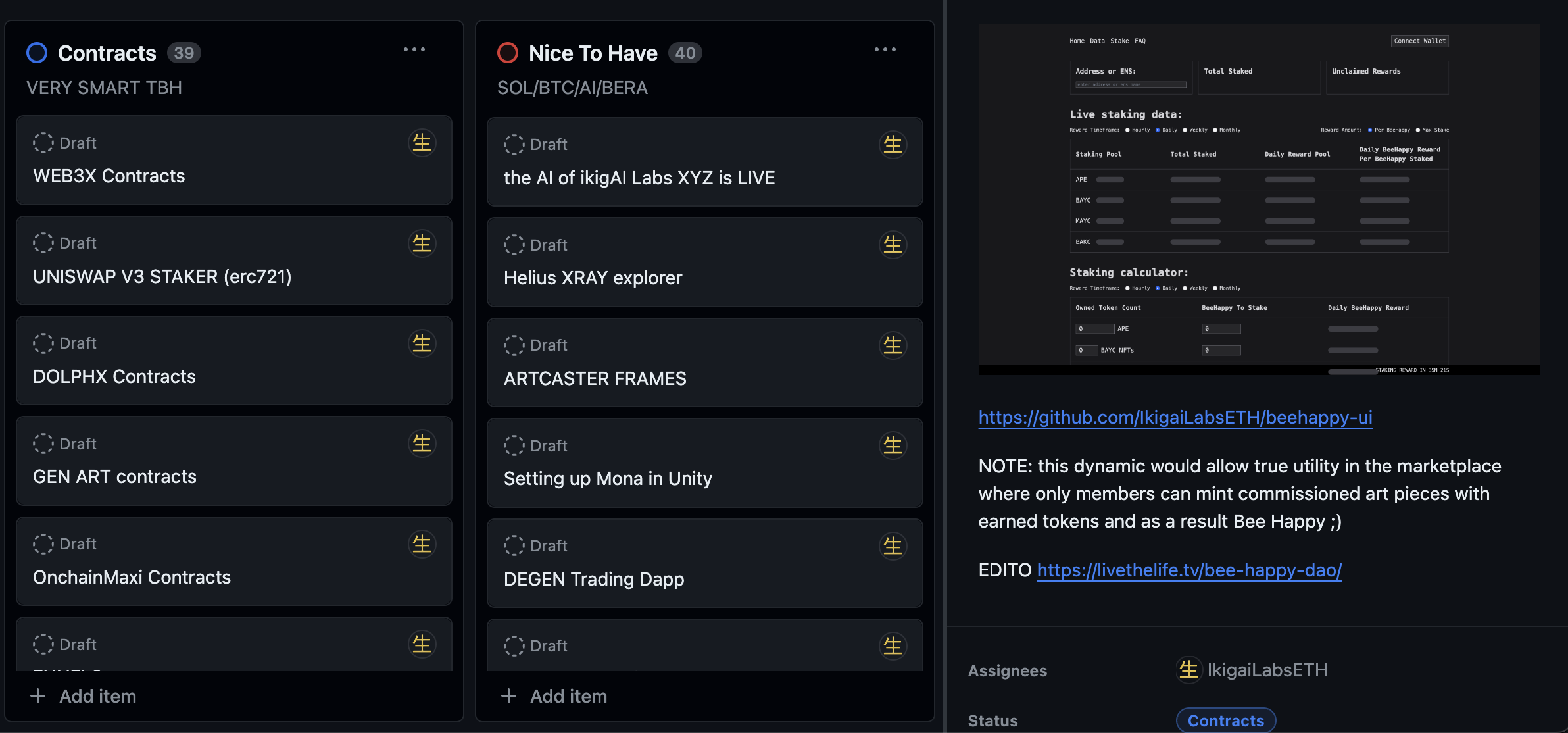

In stark contrast stand the domains of Layer 2 (and L1) solutions, NFT marketplaces (NFTfi) and decentralized finance (DeFi). These areas, characterized by their technical complexity and the requirement for robust, functional products, see far fewer attempts at opportunistic exploitation. The development of L1/L2 protocols, NFT aggregators, or DeFi platforms demands a deep understanding of blockchain technology, smart contract programming, and security measures, acting as a natural deterrent to those looking to capitalize on hype without contributing tangible value.

Implications and Solutions

The proliferation of derivative projects not only dilutes the quality of the ecosystem but also diverts resources and attention from genuine innovation. For newcomers and investors, the challenge becomes discerning legitimate projects with potential from those designed to exploit. This dynamic can lead to a loss of confidence in the crypto market as a whole, potentially stifling growth and adoption.

Addressing this issue requires a multifaceted approach. Enhanced due diligence by investors, increased transparency from project creators, and the development of community-driven standards for evaluating projects could mitigate the risks associated with derivative projects. Additionally, fostering a culture that values and rewards genuine innovation over quick profits is crucial.

As stakeholders in the crypto ecosystem, it is incumbent upon us to promote practices that ensure sustainability and trust. This entails not only individual responsibility in investment decisions but also collective action to elevate standards and accountability. By confronting the challenges posed by derivative projects head-on, we can safeguard the transformative potential of web3 tech.

While the barriers to entry for creating memecoins and NFTs serve as a double-edged sword, promoting inclusivity and innovation on one hand, they also invite exploitation. The community's response to this challenge will define the future trajectory of the crypto ecosystem. It is a call to action for all involved: to prioritize integrity, support genuine innovation, and foster an environment where the true potential of blockchain technology can be realized.

Fair Launch Mechanisms and Liquidity Locking

A promising approach to combating the proliferation of opportunistic projects in the crypto space is the adoption of fair launch mechanisms. These mechanisms are designed to democratize access to new tokens, ensuring that all participants have an equal opportunity to invest. By eliminating preferential treatment, such as pre-sales to insiders or disproportionate allocations, fair launch mechanisms aim to level the playing field and foster a sense of community and trust among investors.

Liquidity locking has emerged as a critical practice to ensure project founders or developers are genuinely invested in the long-term success of their projects. By locking a significant portion of the liquidity in a smart contract for a set period, project leaders demonstrate their commitment to the project's future. This practice not only mitigates the risk of a rug pull, where developers abruptly withdraw liquidity, leaving investors with worthless tokens, but also enhances credibility.

Projects like Uniswap have exemplified the benefits of liquidity locking by ensuring a transparent and secure environment for their users. These protocols have set a standard for accountability, encouraging investors to engage with platforms that prioritize their security and trust.

Free Mints, Airdrops, and Locked Liquidity Pools

An innovative strategy that has gained my personal favor in cultivating web3 communities involves rewarding long-standing members through free mints and airdrops. This approach not only acknowledges the community's loyalty and engagement but also directly invests in the ecosystem's collective success. Moreover, an emerging practice that holds great promise is the integration of secondary sales with locked liquidity pools. By designing smart contracts that allocate a portion of the proceeds from secondary market transactions to these pools, projects can ensure a steady reinvestment into their ecosystem. This method not only secures a foundation for the project's financial health but also aligns the interests of creators, investors, and users toward sustained growth and stability.

Projects like ENS and Uniswap have successfully leveraged these strategies to reward their communities and secure their ecosystems. Through airdrops, ENS recognized early adopters and contributors, while Uniswap's governance token distribution ensured a broad and fair allocation to its users. These strategies not only reinforce the bond between projects and their communities but also set a precedent for future initiatives to prioritize long-term mutual success over short-term gains. As the crypto world continues to evolve, such practices could become the standard, transforming how projects and communities interact and thrive together.